We've asked the question of office product resellers many times about how important e-commerce is for their future, and, most times, the answer comes back that it's "mission critical." However, success stories are few and far between for such a mission-critical objective; Resellers need to think hard about what they understand e-commerce to be and what some effective strategies may be for developing it.

This article aims to develop the argument that, between web traffic and e-commerce, the former is the more important of the two. This is logical because, to create an e-commerce business, you must first build web traffic. E-commerce may be achieved due to web traffic but cannot possibly take place without it.

We've published many articles on the subject of web traffic development. We've stressed, over and over, that accomplishing this objective is not easy and requires a consistent application of time and effort. Suppose e-commerce is genuine "mission critical" for office product resellers. In that case, web traffic is more so, and efforts to develop it must occur before sustainable e-commerce.

Web traffic is a precursor to e-commerce so, traffic development must be more important than e-commerce. With traffic, options are available, without, they are not.

Having established this foundation that web traffic development is more critical (at least initially) than e-commerce, it becomes vital to think carefully about who to target in terms of ideal site traffic.

The following components must be considered:

- Cost of customer acquisition

- Lifetime value, churn, and the inverse relationship between the two

- Visit to lead conversion rates

- Sales funnel conversion rates

Think carefully before you set up a site that (intentionally or not) competes with Amazon or (when it fails) is then made part of the Amazon marketplace!

Amazon was founded in 1994 and, by 2005, had accumulated losses of $2.2 billion and shareholder equity of just $6M! Massive human and financial resources were invested in building its foundation before it became the dominant e-commerce behemoth we know today.

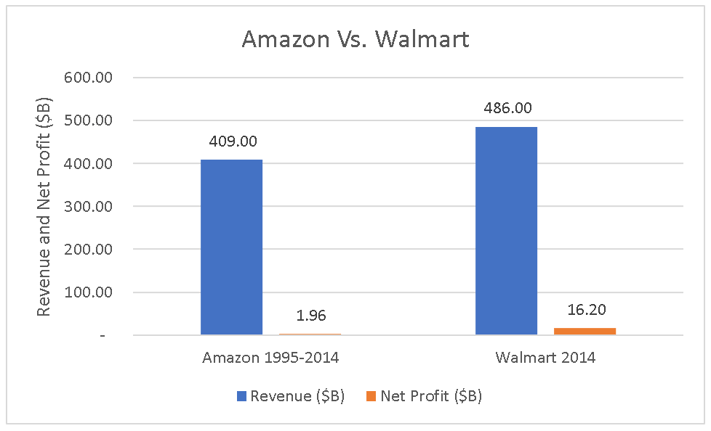

Amazon's cumulative revenue in the twenty years between 1995 and 2014 was $409 billion, and net profits were just $1.96 billion. By contrast, Walmart's revenue in 2014 alone was $486 billion, and its net profit was over $16 billion. In other words, Walmart generated eight times the gain in 2014 than Amazon during the twenty years between 1995 and 2014.

What does this mean for independent office product resellers and their e-commerce strategy?

Attempts to copy Amazon's model will fail - small businesses cannot execute a strategy similar to that of Amazon. Even Walmart will be hard-pushed to close the gap and compete effectively.

Walmart recognizes the threat Amazon poses to its business model and has started to invest billions to develop its e-commerce initiative. The scale of investment required to compete with Amazon is clearly outside the scope of office products resellers.

- Amazon sets the benchmark in terms of e-commerce pricing. However, the Amazon model creates a downward spiral of pricing that can quickly eliminate the weakest players while simultaneously delivering all their customers to the Amazon marketplace. Only Amazon (not the marketplace resellers) has the resources to sustain losses while it builds market share.

- Office product resellers attempting to compete with Amazon must be competitive with their pricing. However, it's low-volume office product resellers can't be price-competitive and make a profit.

- In the Amazon marketplace, where individual office product resellers participate, customer retention is low (churn is high), and average order size is standard. This means the cost of acquisition (relatively high) and lifetime value (relatively low) will likely result in an unsustainable business model.

A strategy that attempts to compete with Amazon and its marketplace merchants is flawed and will almost certainly fail. The pricing model is an issue and competition for their traffic is an issue.

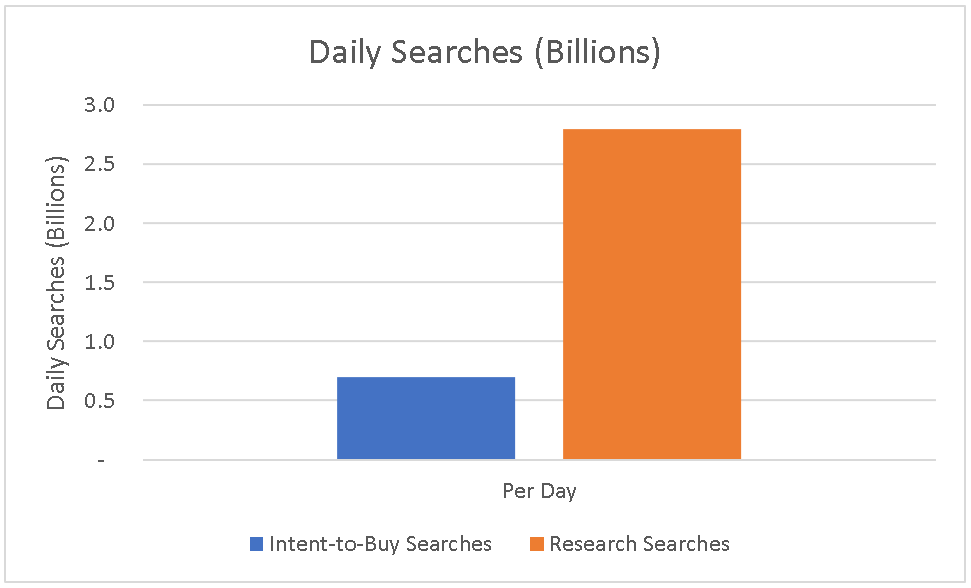

There is an average of 3.5 billion Google searches per day.

- Web traffic goes to Amazon to shop.

- Web traffic goes to Google for research.

- 80%+ of web traffic is researching, not buying.

- Researchers are likely to become shoppers at some point in the future.

The competition for "Intent-to-Buy" searches is high. Unless you're paying for results and have sufficient domain authority to win a place on the first page, satisfactory results are not likely to occur.

The competition for "Intent-to-Buy" searches is high. Unless you're paying for results and have sufficient domain authority to win a place on the first page, satisfactory results are not likely to occur.

Even if office product resellers win a few random searches, subsequent customer transactions will likely be relatively small. Furthermore, it isn't easy to develop loyalty with the resulting profile of customers that are required for repeat orders, up-sell, or cross-sell opportunities or to successfully work on improving these critical business metrics. As a result, average revenue per customer will remain low and churn high. This translates to a high acquisition cost and a low lifetime value which, in turn, does not equate to a sustainable business model.

Please click the image to access a larger version via SlideShare.

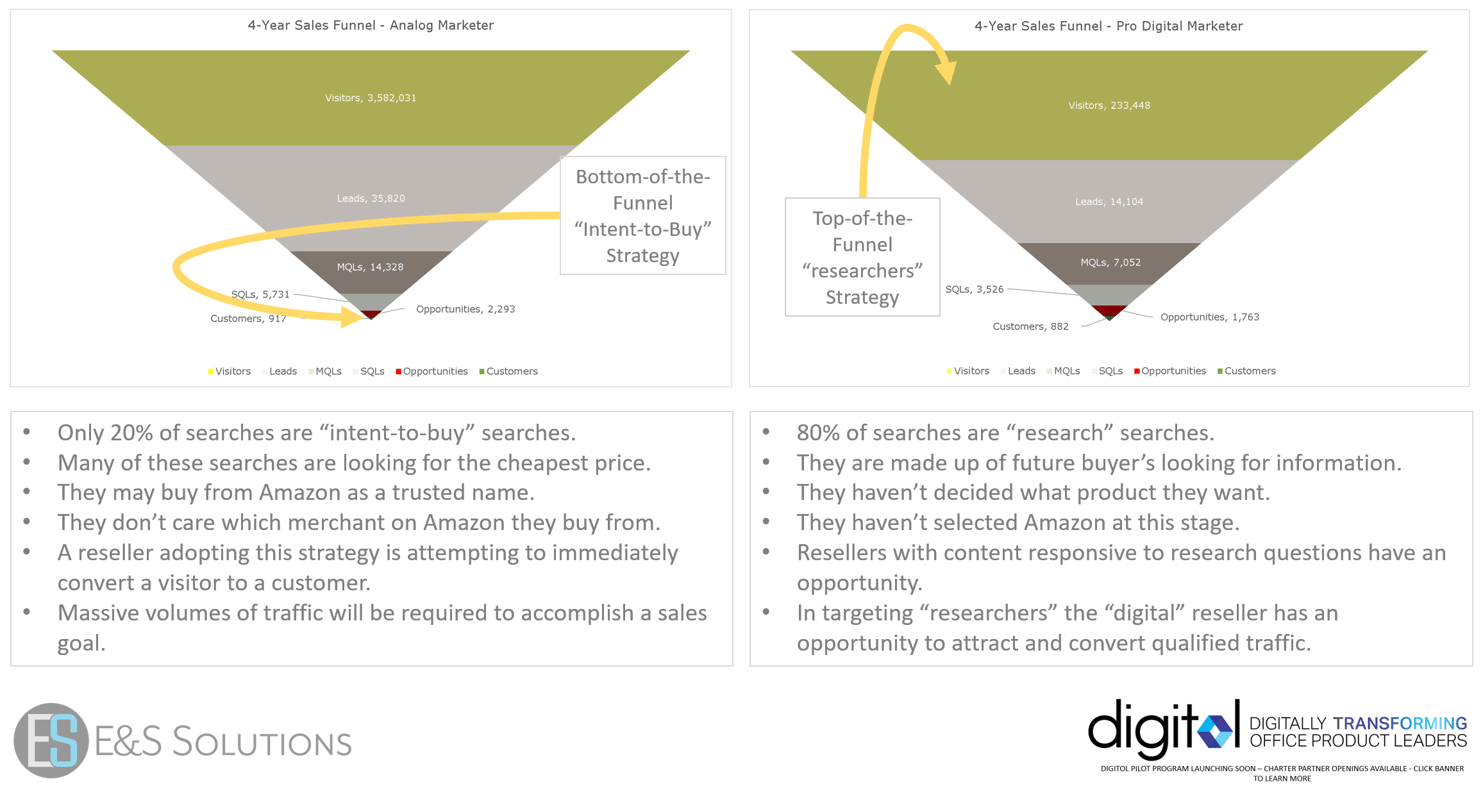

As shown in the two sales funnel images above, the Analog Reseller, using a "bottom-of-the-funnel" instant conversion strategy, needs massive traffic volumes to achieve its sales goal. Conversely, the Digital Reseller, targeting visits from "top-of-the-funnel" researchers for nurturing through the sales funnel, can accomplish the same sales goal with less than 10% of the Analog Resellers' required traffic volume.

As shown in the two sales funnel images above, the Analog Reseller, using a "bottom-of-the-funnel" instant conversion strategy, needs massive traffic volumes to achieve its sales goal. Conversely, the Digital Reseller, targeting visits from "top-of-the-funnel" researchers for nurturing through the sales funnel, can accomplish the same sales goal with less than 10% of the Analog Resellers' required traffic volume.

Furthermore, in developing customer relationships and focusing on its value proposition, the Digital Reseller will likely have lower churn rates, meaning fewer customers are required to reach the same sales goal.

<a href=https://agmxwwnq.wordpress.com/2025/05/04/salat-iz-burjaka-ta-ogirkiv-solonih/>блог рецептів</a>

Dispositivos de equilibrado: importante para el funcionamiento suave y efectivo de las maquinarias.

En el mundo de la avances actual, donde la efectividad y la confiabilidad del sistema son de suma significancia, los sistemas de equilibrado desempenan un rol vital. Estos aparatos adaptados estan desarrollados para calibrar y fijar piezas moviles, ya sea en dispositivos de fabrica, vehiculos de transporte o incluso en electrodomesticos caseros.

Para los especialistas en conservacion de dispositivos y los ingenieros, trabajar con equipos de balanceo es crucial para garantizar el rendimiento fluido y fiable de cualquier aparato dinamico. Gracias a estas opciones innovadoras innovadoras, es posible reducir notablemente las vibraciones, el estruendo y la presion sobre los rodamientos, extendiendo la tiempo de servicio de componentes valiosos.

De igual manera significativo es el funcion que tienen los sistemas de calibracion en la asistencia al consumidor. El apoyo tecnico y el soporte permanente empleando estos dispositivos permiten ofrecer asistencias de optima calidad, mejorando la agrado de los usuarios.

Para los propietarios de negocios, la inversion en sistemas de equilibrado y detectores puede ser esencial para aumentar la efectividad y rendimiento de sus dispositivos. Esto es especialmente relevante para los emprendedores que manejan reducidas y modestas empresas, donde cada aspecto importa.

Por otro lado, los dispositivos de balanceo tienen una vasta aplicacion en el sector de la seguridad y el monitoreo de estandar. Habilitan identificar posibles defectos, previniendo reparaciones elevadas y averias a los dispositivos. Incluso, los informacion obtenidos de estos aparatos pueden usarse para perfeccionar sistemas y incrementar la visibilidad en motores de exploracion.

Las sectores de utilizacion de los aparatos de equilibrado incluyen variadas sectores, desde la manufactura de transporte personal hasta el monitoreo del medio ambiente. No influye si se habla de importantes manufacturas de fabrica o modestos establecimientos de uso personal, los aparatos de equilibrado son fundamentales para garantizar un funcionamiento productivo y sin paradas.

Equipos de balanceo: fundamental para el operacion uniforme y eficiente de las maquinas.

En el ambito de la tecnologia moderna, donde la rendimiento y la fiabilidad del dispositivo son de gran relevancia, los equipos de balanceo cumplen un funcion vital. Estos equipos dedicados estan desarrollados para equilibrar y regular piezas rotativas, ya sea en equipamiento productiva, medios de transporte de traslado o incluso en electrodomesticos hogarenos.

Para los tecnicos en mantenimiento de dispositivos y los especialistas, trabajar con equipos de calibracion es esencial para promover el rendimiento fluido y confiable de cualquier mecanismo giratorio. Gracias a estas alternativas tecnologicas sofisticadas, es posible reducir significativamente las sacudidas, el ruido y la presion sobre los sujeciones, mejorando la vida util de componentes costosos.

Asimismo importante es el tarea que juegan los aparatos de calibracion en la servicio al comprador. El soporte profesional y el reparacion regular empleando estos sistemas facilitan proporcionar soluciones de alta excelencia, mejorando la contento de los compradores.

Para los titulares de negocios, la financiamiento en equipos de balanceo y medidores puede ser clave para incrementar la eficiencia y eficiencia de sus sistemas. Esto es principalmente trascendental para los empresarios que administran modestas y pequenas empresas, donde cada punto es relevante.

Tambien, los equipos de calibracion tienen una amplia utilizacion en el sector de la proteccion y el supervision de calidad. Posibilitan detectar eventuales problemas, evitando arreglos caras y perjuicios a los aparatos. Ademas, los indicadores obtenidos de estos sistemas pueden aplicarse para perfeccionar sistemas y aumentar la exposicion en plataformas de consulta.

Las zonas de utilizacion de los equipos de ajuste incluyen multiples areas, desde la manufactura de vehiculos de dos ruedas hasta el monitoreo ambiental. No interesa si se refiere de enormes elaboraciones industriales o pequenos talleres de uso personal, los aparatos de balanceo son esenciales para proteger un rendimiento productivo y sin interrupciones.

<a href=https://mydovidnikgospodarya.xyz/>Каталог</a>

Equipos de balanceo: esencial para el operación fluido y efectivo de las máquinas.

En el entorno de la ciencia moderna, donde la efectividad y la seguridad del sistema son de suma trascendencia, los aparatos de calibración desempeñan un papel crucial. Estos dispositivos especializados están concebidos para balancear y asegurar partes rotativas, ya sea en herramientas de fábrica, automóviles de transporte o incluso en dispositivos de uso diario.

Para los expertos en conservación de equipos y los profesionales, operar con aparatos de equilibrado es esencial para promover el operación suave y confiable de cualquier aparato móvil. Gracias a estas alternativas tecnológicas modernas, es posible minimizar considerablemente las movimientos, el zumbido y la carga sobre los sujeciones, mejorando la tiempo de servicio de piezas valiosos.

También significativo es el función que tienen los sistemas de ajuste en la servicio al consumidor. El soporte especializado y el mantenimiento continuo aplicando estos aparatos facilitan dar asistencias de gran estándar, incrementando la contento de los usuarios.

Para los propietarios de empresas, la inversión en equipos de equilibrado y medidores puede ser importante para aumentar la rendimiento y eficiencia de sus sistemas. Esto es principalmente relevante para los inversores que gestionan modestas y modestas organizaciones, donde cada detalle es relevante.

Asimismo, los aparatos de equilibrado tienen una vasta implementación en el campo de la seguridad y el monitoreo de estándar. Posibilitan localizar probables problemas, previniendo arreglos elevadas y averías a los sistemas. Incluso, los indicadores obtenidos de estos aparatos pueden emplearse para maximizar métodos y potenciar la exposición en motores de búsqueda.

Las sectores de utilización de los sistemas de calibración incluyen numerosas industrias, desde la fabricación de ciclos hasta el supervisión del medio ambiente. No interesa si se considera de extensas elaboraciones industriales o modestos talleres domésticos, los sistemas de equilibrado son necesarios para garantizar un rendimiento productivo y libre de paradas.