The current theme of our blog has focused intently on attempts to jolt the independent resellers of office equipment, products, and supplies into taking action to enter the digital world comprehensively. For them to do so, it's necessary to overhaul thousands of underperforming websites and social media accounts and then start the wide-scale implementation of sophisticated digital marketing to develop consistent and relevant inbound web traffic.

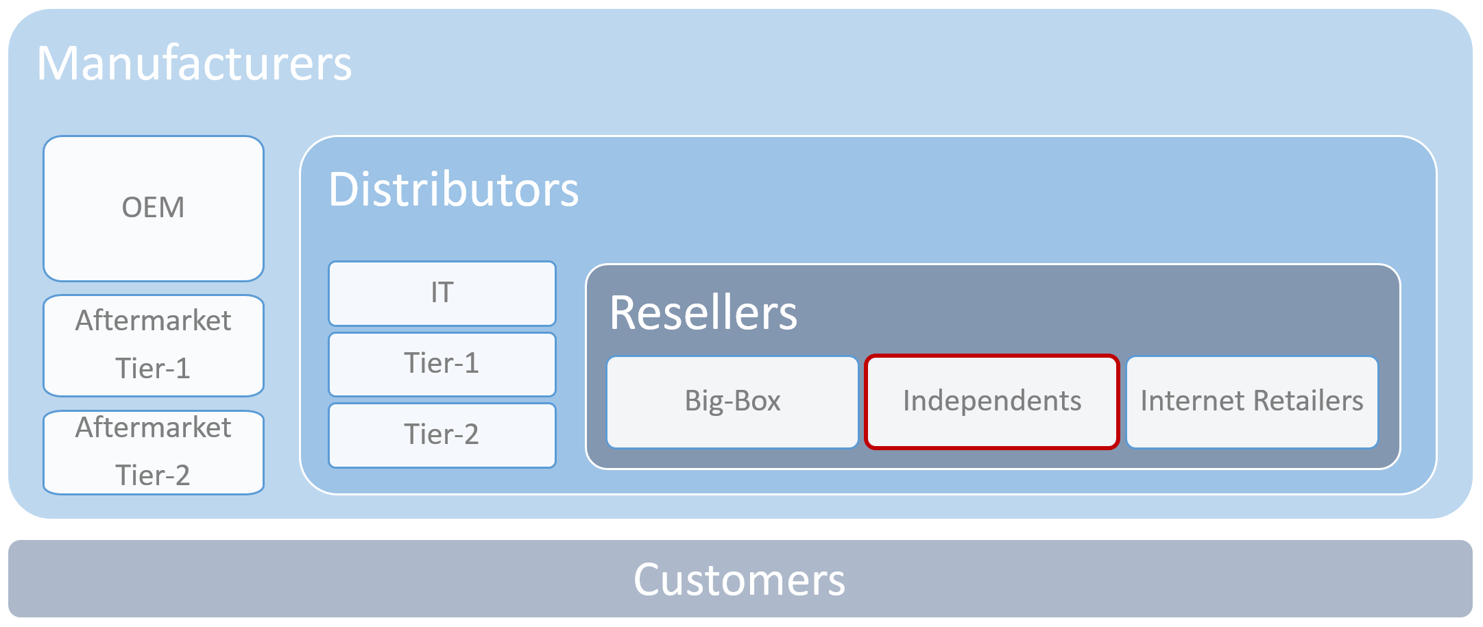

The graphic below illustrates how office products and equipment are managed through the supply chain on their journey to the customer. It can be a logical, well-ordered journey, or it can be chaotic. As an industry matures (i.e., Office Products and Equipment), it's likely to become more chaotic.

A well-ordered value chain may typically see the manufacturers selling to distributors and the distributors selling to resellers, who then sell to the end customers. Although this flow is over-simplified (there are always distortions regardless of the consolidation stage and different vertical requirements), it's useful for illustrative purposes.

The United States Office Equipment & Supplies - The Path to Market

What's important to understand is that the distributors and resellers only have a business so long as the manufacturers need them to carry out the logistics for the sales, marketing, and fulfillment of their products to the end consumer.

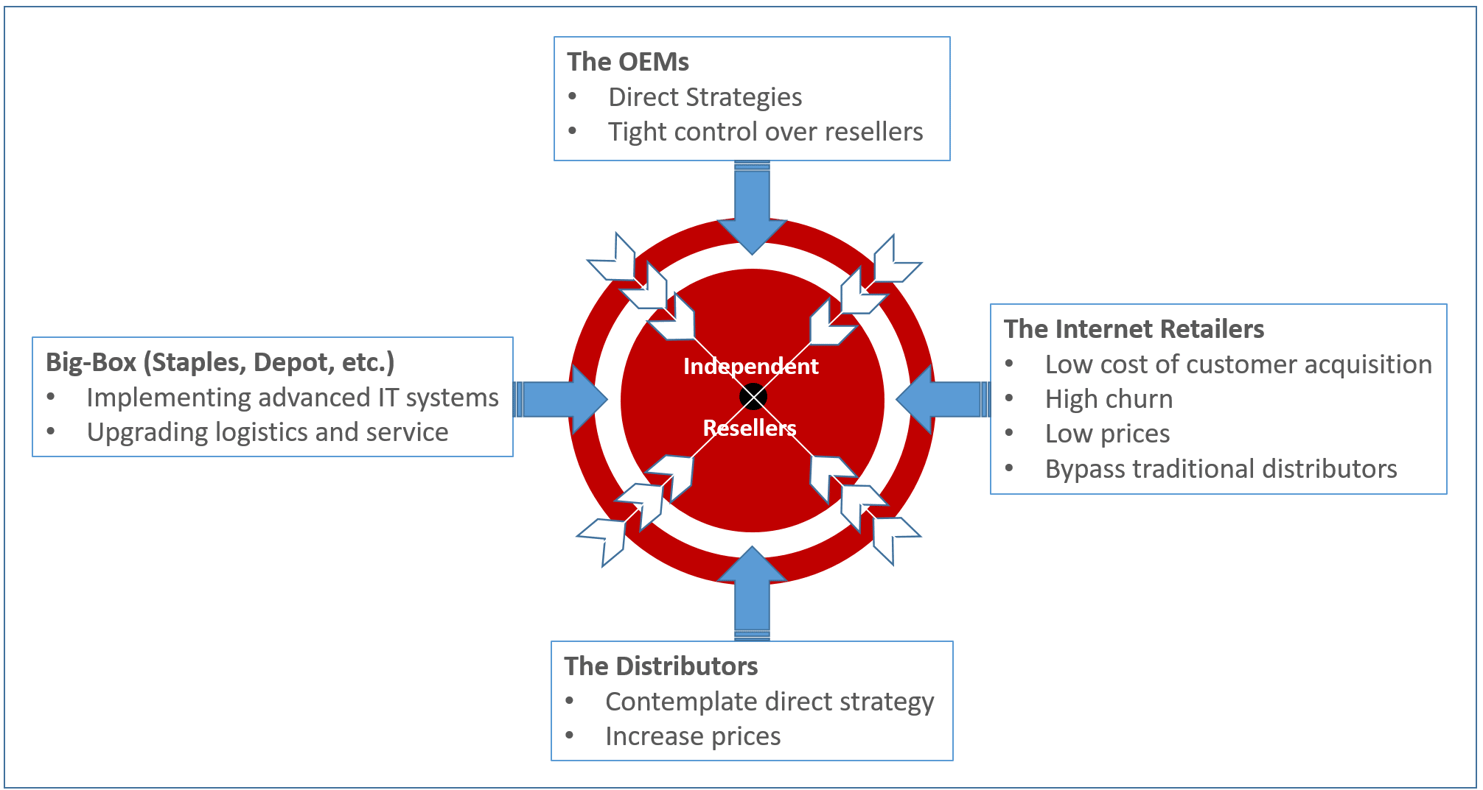

The Independent Resellers are the group facing the greatest go-forward disruption risks.

Today, the OEMs already make some sales directly to the end consumer. While they may use distributors for fulfillment, they [the OEM] own these customers, and the reseller is eliminated from the value chain. In addition to controlling the customer relationship (which may also reduce the risk of churn), the manufacturer keeps the margin the reseller would have made. However, there's a price to pay as the OEM incurs sales, marketing, and administrative costs that erode the extra margin earned from the direct sale.

Many industries, including office products, have been through cycles as the manufacturers flip-flop their distribution strategies, with most ultimately realizing ownership of that final customer is a lot more expensive than they had hoped for.

However, what may be different in the current cycle are the results of the manufacturer's incremental deployment of sophisticated information technology that helps them deal more efficiently with large numbers of end-user customers than they ever previously could. There are no longer any surprises regarding the cost of customer acquisition, churn, and lifetime values.

If the cost of customer acquisition is greater than lifetime value, then a sustainable business model does not exist.

The use of technology and sophisticated digital marketing has reduced the cost of customer acquisition and churn, increasing lifetime value. However, the problem is that independent resellers have almost universally failed to implement the information technology-related improvements that the manufacturers have. As a result, when combining the impact of the manufacturer's achievement and the reseller's failure, a manufacturer's strategy to eliminate the reseller from the value chain is far more likely to be sustainable than in previous cycles.

A reseller comforting itself thinking "I've seen it all before, they'll be back when they realize how much value I add", is likely to be rudely awakened this time around!

It's the independents that face the most significant risk. They're stuck in the middle, squeezed from all directions.

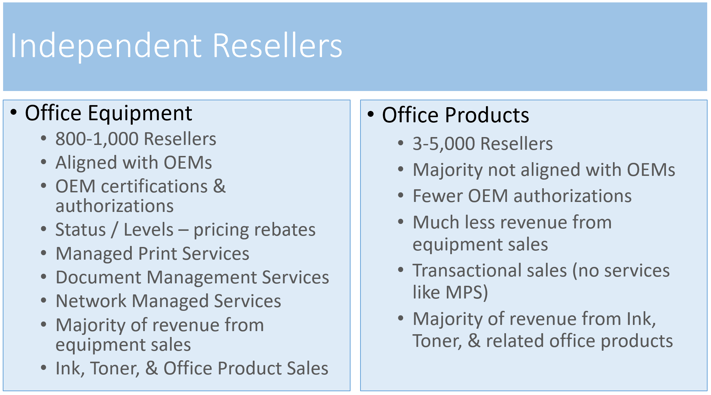

The independents can be divided into two distinct groups:

Assuming the Office Equipment resellers have average annual sales of $10M and the Office Products resellers an average of $500k, then we can summarize these two components of the channel as follows:

We've estimated $12.5 billion of channel sales through independent resellers, with 80% of this volume going through the 1,000 Office Equipment resellers. As larger businesses, the OE resellers have more significant resources to implement improvements than the smaller OP resellers.

It may be optimistic to assume 5,000 OP resellers still remain but, worse may yet be to come, as time runs out for most of them to take enough action to continue the fight for survival.

While the outlook may be especially dire for most OP resellers, it's no longer a walk in the park for the OE resellers. They face severe competitive threats from the OEMs, Amazon, and maybe even some big-box guys as they up their ante.

What's a path forward?

We've blogged about the Office Equipment & Products resellers needing to balance profitable growth and preservation of their OEM reseller authorizations. As they consider their options, one avenue may be for them to aggressively enter the OP channel by acquiring these struggling and, most likely, undervalued businesses. In doing so, they will face:

- Less conflict with OEM reseller authorizations

- Upsell and cross-sell opportunities by leveraging their OE skills

While this strategy could represent an opportunity for skillful OE resellers, it will not automatically alter the competitive threats they currently face, even as a more extensive, "hybrid" OE/OP reseller. They will remain in the middle, squeezed, and vulnerable to all the threats highlighted in this article. Therefore, besides contemplating the potential upside of the hybrid OE/OP structure, they must have a similar strategy to grow the top line organically.

A $10 million OE reseller acquiring a $1 million OP reseller that fails to fix churn or develop the capability to increase market share, will still end up as a $10 million business less than a year later!

While the OP reseller may represent a soft underbelly of the industry (as the weakest component of the value chain), the OE reseller pursuing an acquisition strategy must find another soft underbelly higher in the value chain. It must then develop tactics and strategies to win market share from that sector profitably.

If they fail to do so, then no amount of OP acquisitions will ultimately save them either.

In Part 2 of this mini-series, we'll explore areas of the value chain that may represent the best opportunities for resellers to develop market share profitably.

Conclusions:

Independent office products and equipment resellers face three different outcomes:

- Successfully implemented strategies to increase market share

- Sold the business

- Went out of business

Resellers who don't have the energy or resources to set about increasing market share should look for suitors immediately before it's too late. Those resellers who think they can make a decent attempt at a digital business transformation may start down the path, reducing churn and customer acquisition costs and making their businesses more attractive for future acquirers.

Ultimately, the office products industry winners will be those who complete their digital business transformations, sensibly acquire weaker rivals, achieve synergies with the combined businesses, and implement digital strategies to protect the business base they receive.