Over the last decade or so, only a handful of office products (and virtually no business equipment) resellers have developed successful e-commerce revenue streams. Despite the decline in North American reseller numbers during this time frame, thousands remain, and of the hundreds of those that have tried to develop an e-commerce business, most have failed to do so.

It all seems so simple when casting an eye at the OEMs, Office Depot, Staples, and Amazon. Between them, they are transacting billions of e-commerce dollars, which must appear to be such a simple process from an outsider's viewpoint.

The technical challenge of putting up an online catalog for conducting e-commerce for small businesses is not, by any means, impossible. So, let's assume for a moment that, both from a technology and a depth of product line perspective, smaller resellers can offer an equivalent e-commerce offering to those deployed by the big guys.

If this is the case (and we think it is), then it can't be a lack of technology or a limited product selection (catalog) preventing smaller independents from success.

So, what is it?

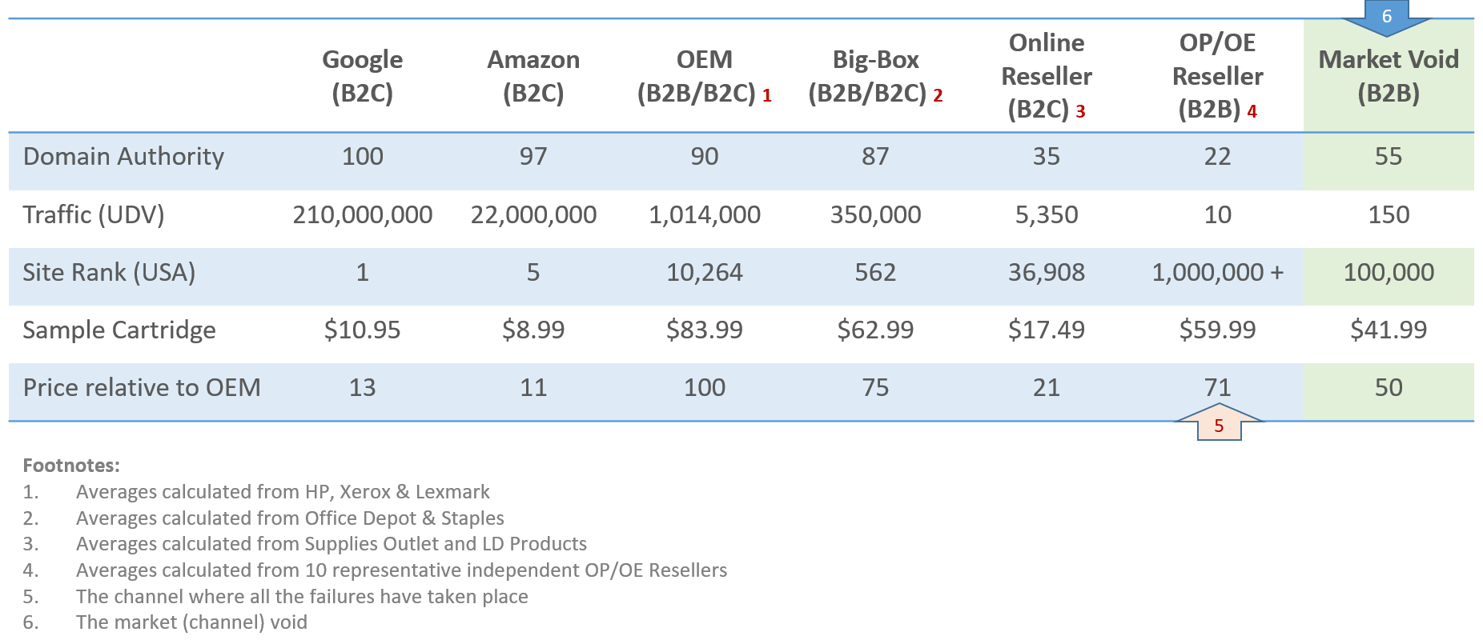

The table below has been prepared to help explain the problem facing independent office product resellers and e-commerce initiatives.

As it turns out, the core issue is a lack of domain authority, a simple problem to identify but not so simple to address!

Just compare Big-Box domain authority with that of an independent OP/OE reseller - 87 Vs. 22!

Why is Domain Authority so important?

Bottom line, even if reseller websites were fully optimized for SEO (which is rarely the case) and carefully built around popular keywords (i.e., "Office Supplies"), then the sites still don't rank well for these search terms because their domain authority is so weak compared to that of well established online competitors.

An independent reseller's website will typically rank at 100+ for popular keywords (meaning they will appear sometime after the 10th page of the search results), and, as we all know, no one clicks through 10 pages looking for an acceptable result!

Unfortunately, the dilemma is without the reseller organically ranking for searches on popular keywords; there's no way to generate the necessary number of site visits required to develop a business using the B2C approach historically taken successfully.

Furthermore, even setting the required domain authority issue to one side for a moment, the costs associated with using a paid keyword search for developing web traffic means it's not a viable option for most resellers.

The second problem is pricing.

Look closely at the "Online Reseller" channel - the average price on the cartridge example we chose is $17.49, whereas the average price in the OP/OE channel is $59.99. Regardless of whether or not a reseller can improve its site domain authority to 50+ to achieve a better ranking on popular keyword searches, it still won't develop a B2C e-commerce business using its current pricing structure.

Please click this link for a related article explaining why we focus on aftermarket office supplies to increase OP & OE resellers' market share.

Even if a dual pricing strategy can be successfully managed, the reseller must still overcome the significant hurdle of increasing its web traffic from 10 UDVs to 3,000 or more. Of course, this is very unlikely to happen with the current approach.

- It would take a long time.

- It would take considerable expertise.

- The effort must be funded.

Funded, that is, while offering a product at a 70% discount to current pricing!

Resellers who aspire to develop a successful B2C e-commerce business must accept the pricing rules, must increase their domain authority, and must develop web traffic with all the associated costs and time frames that come hand-in-hand with that project!

The proceeding data table has laid out the cold, hard facts and those facts are not going to change!

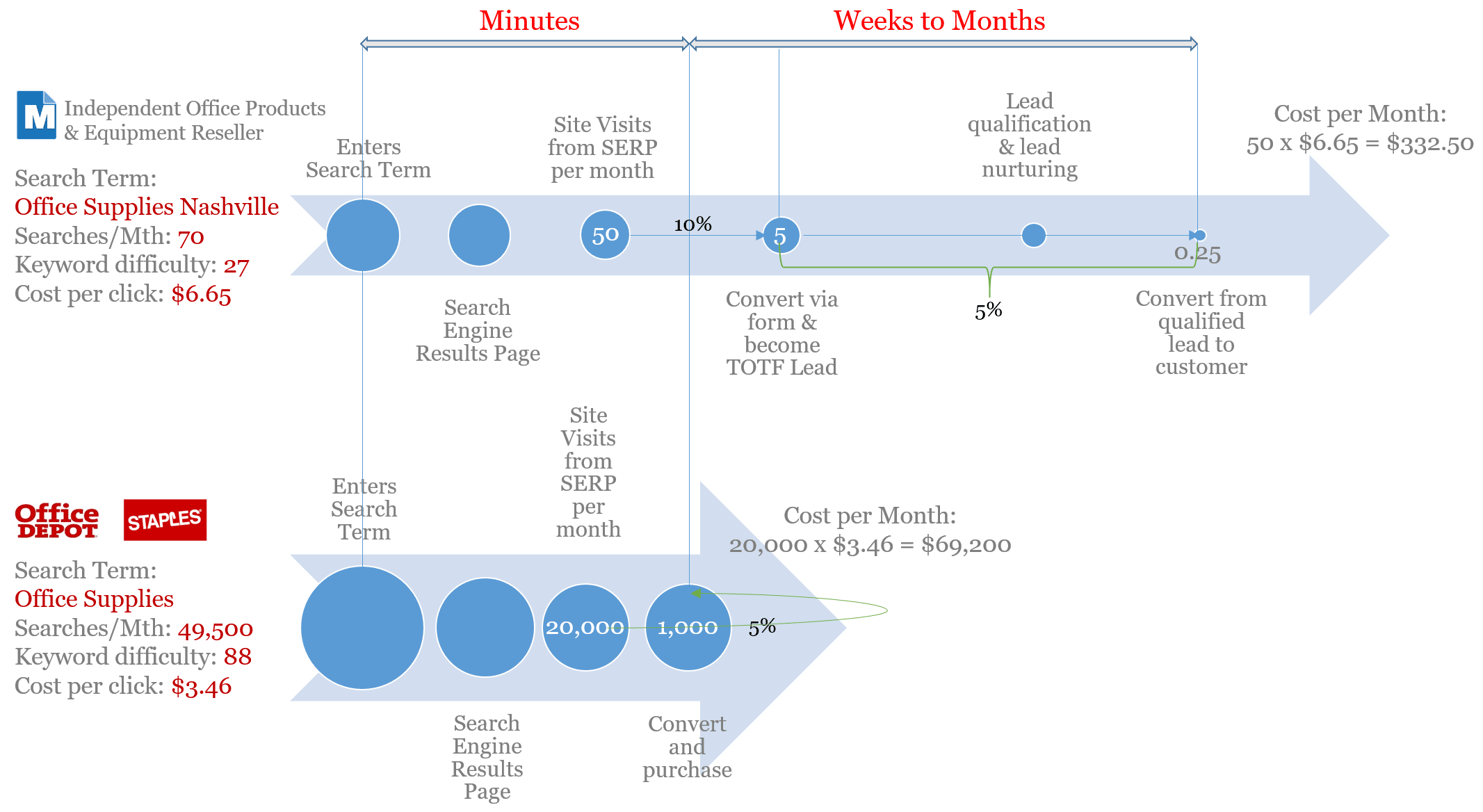

Because of these facts, the mindset for the initial conversion currency for independent resellers must be changed from dollars to leads. This means the time horizon for the selling cycle must be extended to account for those leads having to be worked through the sales funnel until a portion of them are eventually converted to customers.

Trying to accomplish a goal to win new customers online, while ignoring the longer selling cycle associated with converting to a "visit-to-lead" versus a "visit-to-sale" strategy, is doomed to fail!

The traffic heading to popular e-commerce sites is far more likely to have an "intent-to-buy" motive. However, as we've explained, smaller independent resellers cannot win this traffic because of the enormous competition cost.

Furthermore, suppose this tactic is deployed by a reseller attempting to boost an e-commerce business. In that case, it results in a high customer acquisition cost and, when combined with the typical persona of the conversions and the lower likelihood of them ever becoming loyal, long-term customers, that high purchase cost will not be paid back.

These two factors (high CAC and low LTV) combine to ensure a startup "pay-for-traffic" strategy fails.

Fortunately, most independent office products and equipment resellers are not investing in the potential sinkhole of paid-traffic strategies to convert surfers, at the "intent-to-buy" stage of the buying cycle, into customers.

- First, most don't have the level of know-how required to execute a paid traffic strategy.

- Second, they don't have the domain authority to rank in searches for popular (high volume) keywords.

- Third, most don't have the financial resources to pay for enough traffic to make a difference.

- Fourth, the resulting ratio between CAC and LTV would mean the investment would never be paid back.

What's required for a "top-of-the-funnel" lead development strategy?

For resellers who understand the necessity for developing "top-of-the-funnel" sales leads and who deploy strategies to attract relevant inbound web traffic, they must (as one component of their content) make their product offering and list prices easily accessible.

This means showing a catalog of products, availability, and pricing without forcing visitors to wait for a "new-customer-registration" process to be approved. Restricting access is far more likely to generate a "bounce" instead of allowing for the potential of a well-qualified prospect to convert to become a lead!

The honest pricing component of an online strategy seems to give office products and equipment resellers heartburn because they know either:

- Pricing for an online B2C initiative will be much lower than their current B2B prices, creating a significant conflict with existing customers.

- The pricing for a B2B initiative will be much higher than "internet" pricing, so no one will ever engage simply because published prices are not competitive.

Resellers seem to fear that, by not having the the most competitive internet prices, they will get no web traffic.

This fear may be justified so far as the "bottom-feeding-immediate-intent-to-buy" surfers are concerned; ultimately, as we've explained, this traffic category will find the lowest price anyway and is unlikely to have an acceptable LTV profile.

Most resellers don't seem to get that it's OK for the random "bottom-feeders" to never arrive at their site or, if they do, to bounce right out of it.

- This isn't traffic that should be targeted; as we've already established, independent resellers cannot effectively compete for it.

- However tempted resellers may be to push for a quick result, they must let that traffic and any potential business it could bring go straight to Amazon and the other established B2C e-tailers!

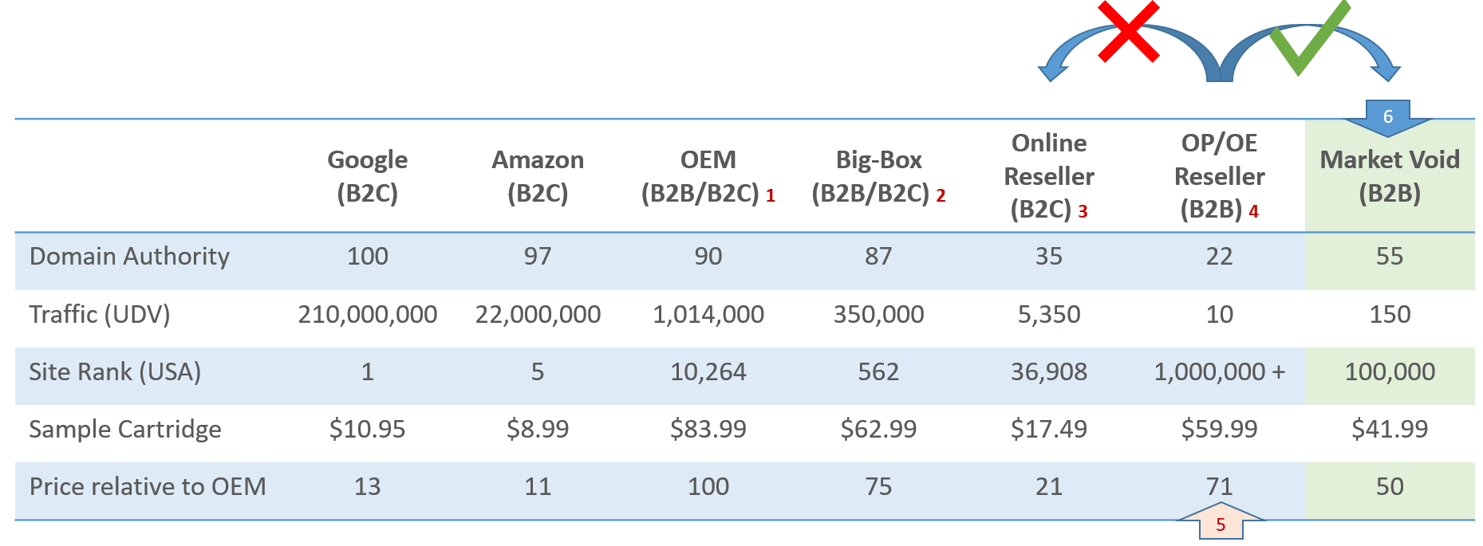

Look at the Big-Box channel and its published internet pricing compared to that available on Amazon and Google. Depot and Staples, who make up a big part of "Big-Box," are NOT the cheapest on the internet, yet they have massive traffic volumes and substantial e-commerce sales.

Office Depot and Staples don't offer the lowest internet prices but that doesn't mean they're shy about displaying prices! Instead, they rely on their brand authority and their value proposition to win customers!

So, where's the market opportunity?

Historically, the independent reseller's failure to develop e-commerce is strongly associated with their direction. Cast your eye again to the data table (below) and look at the "Market Void" column. Instead of taking the futile path on the left toward an online B2C initiative, resellers must switch direction and attempt to develop an online B2B channel.

Look closely at the Big-Box B2B/B2C channel. Look at the web traffic (350,000 UDVs), the domain authority (87), and the ASP on aftermarket cartridges at 75% of the OEM price. If Big Box can be successful with these metrics, then that's what independent resellers must emulate to grow their businesses profitably.

Working to develop their DA to 55, their UDVs to 150, setting their aftermarket cartridge pricing to a 50% discount compared to the OEM and a 33% discount to a comparable aftermarket product through Big-Box, and the model starts to work. 150 UDVs equates to 4,500 visits per month. 2.5% conversion equals 112 leads, and 5% conversion of leads to customers eventually results in 5 new customers!

Is there a role for paid traffic?

We're not saying there's no place for a "paid-traffic" strategy. Indeed, this can be significantly accretive when deployed to extend a reseller's reach, develop brand awareness, and expand its influence. However, these paid efforts should also be targeted at "top-of-funnel" sales leads rather than mistakenly trying to seek out transient buyers who, though they may well have an immediate "purchase decision intent," are surfing for the best prices available on any given day.

Purchasers with "bottom-feeding" habits will most likely be doing the same on subsequent purchases so, the chances of winning a loyal customer, are low.

The ONLY way the strategy we've explained will work is when it's "content" driven!

For a B2B initiative to work, the reseller must create content (in addition to its product catalog) to execute a successful inbound strategy. Remember, this strategy requires targeting "top-of-the-funnel" sales leads and targeting visitors who are not at the decision stage of the buying cycle.

This strategy means deploying content that has been created to educate visitors and to build trust.

The approach is quite deliberate, but the consequence is that it doesn't result in an immediate sale. Instead, as we've explained, it requires a longer selling cycle to allow for the time needed to develop brand awareness and trust in the value proposition. The objective is that when the lead has reached its decision stage in the buying cycle, the marketer has successfully positioned its business to benefit from that decision.

One of the many consequences of this strategy is that different content has to be created that can be effectively targeted to varying personas at various stages of the buying cycle. This content must be delivered through blogging, social media, and clever, direct email marketing strategies.

Conclusions:

While it may be convenient to think (hope) it's possible to open up an online store and then sit back and wait for the orders to start flowing in, it's simply never going to happen.

Furthermore, something far more fundamental is taking place here, and that's the matter of business survival. To survive, more and more businesses are being forced to upgrade their capabilities and improve their value proposition. Those that don't (including office products and equipment resellers) face ever-increasing churn (loss) on their customer base and are eventually destined to go out of business.

It's not just a question of figuring out how to start doing e-commerce; it's about improving the value proposition, embracing technology, making it possible for customers to do business seamlessly, and filling a sales pipeline with qualified leads to help develop an office products growth opportunity, profitably increase revenues, and increase market share.