Part 3 - So .... what's the web traffic development roadblock?

In the first two posts of this four-part series, I established the foundation for arguing the importance of a world-class website and creating content published and accessible from that website that effectively caters to the interests of potential buyers. The content provided on a website must cater to potential buyers who may be at different stages of their buying "journey" and may be researching for different types of information. Business owners must remember web traffic does not consist solely of e-commerce! Most traffic at any time is not taking place to make a buying decision.

In the first two posts of this four-part series, I established the foundation for arguing the importance of a world-class website and creating content published and accessible from that website that effectively caters to the interests of potential buyers. The content provided on a website must cater to potential buyers who may be at different stages of their buying "journey" and may be researching for different types of information. Business owners must remember web traffic does not consist solely of e-commerce! Most traffic at any time is not taking place to make a buying decision.

I also explained in these first two posts that even if a company develops a world-class website and creates and strategically publishes world-class content, it's still not enough to establish significant web traffic. Traffic will not automatically grow from such passive strategies.

Finally, I touched on what some readers may believe to be an apparent flaw in my argument by pointing out that the organizations that currently have large volumes of site traffic and conduct successful e-commerce don't appear to publish the informational and educational content I'm advocating.

Instead they rely on thousands of product reviews generated by their customers that have (and continue) to establish the means to build trust and confidence of site visitors for ongoing transactions. The scale and volume of product reviews is simply outside the scope of a small business.

So, to understand why a small group of large companies dominates web traffic and e-commerce and why simply copying their strategies will not work for small businesses, we must know how these large organizations continue to attract traffic to understand why similar tactics are not viable for small businesses.

We also have to understand the "rules" for determining whether a website appears prominently in results from popular search engines such as Google and Bing.

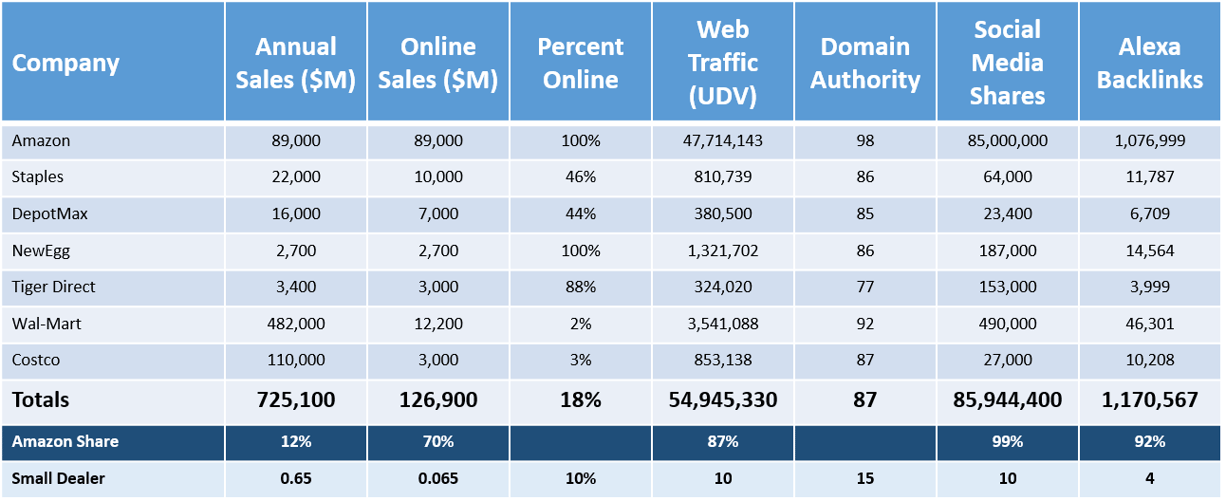

The table below shows some of the most important key performance indicators (KPIs) of the most prominent resellers in the office products vertical.

The seven companies listed in this table have annual global sales of $725 billion, of which 18% or $127 billion is conducted online. Between them, they have 55 million unique daily visitors, 86 million social shares, an average domain authority of 87, and almost 1.2 million backlinks.

However, within this group of seven, look at how dominant Amazon is - although accounting for only 12% of the $725 billion in annual sales, they have 70% of the $127 billion in online sales, 87% of the daily traffic, 99% of the social shares and 92% of the backlinks. Now look at Walmart; despite accounting for over 65% of the total sales and despite being the second largest internet retailer with $12.2 billion in online sales, this only represents 2% of their total sales, 1.5% of the total daily traffic, and 3% of the total backlinks. Wal-Mart has been left behind in the race to establish an online presence and is starting to face a significant risk of becoming the next Eastman Kodak or Sears Roebuck!

Finally, take a look at the last line in the table that's intended to represent a small office products reseller with $650,000 in annual sales, of which 10% or $65,000 may be conducted online, only ten unique daily site visitors, a domain authority of 15, 10 social shares and four backlinks. Based on a study of nearly 200 office product websites, these are the typical metrics of over 85% of small to medium size office product reseller sites!

I'll return to the plight of the office products dealer and the significance of these numbers later in this post.

First, I want to briefly explain the importance and relevance of each of these key performance indicators.

Domain Authority

Domain authority (DA) is a website metric developed by Moz, and the higher the DA, the more likely it is that a website will have substantial traffic. DA is established from many factors, including the site's link profiles, the quality of the content and how frequently its updated, the internal page linking, and the "age" of the domain itself.

Backlinks

The number of backlinks is treated as an indication of the popularity or importance of a website, but more weighting is applied to high-quality links. For a business to invest time to establish links back to its website, those links must come from relevant sites - the higher the relevance,e, the more significant the quality, and the higher the search engine "score." Search engines ignore irrelevant inbound links, but all outbound links are calculated, so if outbound links are not high quality, they dilute the "relevancy" score and diminish search engine result standings.

Social Shares

Social shares, sometimes described as the "social currency," are easily facilitated by incorporating "social share" buttons on a website's blog. They quickly and easily allow readers to share articles or content they have enjoyed on various social media platforms. The importance of this activity should be immediately apparent in terms of expanding the audience content can potentially be exposed to. By including links and other "calls-to-action" in scope, traffic can be attracted back to the site it originated from, so the more significant the audience,e, the greater the potential volume of traffic is likely to be.

The typical Office Products reseller

Let's look at these requirements in the context of a smaller office products reseller that's been around for 15+ years and doesn't currently have significant site traffic and e-commerce. A 15-year-old domain has lots of potential value, but the potential has not been realized because the reseller has failed to understand the importance of building relevant backlinks.

However, a world-class website with world-class content is an unavoidable prerequisite for building high-quality backlinks. Unfortunately, very few office product sites meet this standard, and very few office product resellers have understood the need for backlinks to establish higher standings in search results and trust and authority in its field.

Why would a researching buyer do business with a company that fails to present itself in a manner that demonstrates authority and trust in its field?

If a business fails to build it's DA, it fails to appear in search results. If a company fails to deploy a world-class website, it fails to provide a platform for engaging potential site traffic. If it fails to create and publish high-quality, relevant content, it fails to demonstrate its authority in its field and build trust with its target audience. If it makes a world-class site and creates world-class content but fails to construct social shares, then it fails to expand its audience and leverage the potential for building traffic from that content.

Unfortunately, the clock can't be turned back for the office products reseller - if only an effective link-building strategy had started 15+ years ago and an average (for example) of five backlinks per week had been developed. Over 15 years, that would add up to nearly 4,000 backlinks - almost two-thirds of the number OfficeDepot has established in its lifetime. Look at their DA at 85 and imagine where 10,000 office product resellers would be and what the aftermarket share and profitability of the channel may be if the reseller community had established this level of DA!

Well, it's no good lamenting what hasn't happened, and it's easy to identify this massive failing with the benefit of hindsight. Still, the key now is to start to make up for lost time and provide the support the industry requires for building its DA and participating in the $20 billion growth opportunity.

It should be clear what's required:

- A world-class website

- World-class content with frequent updates

- A social strategy for shares and audience building

- Building and measuring domain authority

In this series's fourth and final blog, I'll present our solution for the office products industry. It's not a "silver bullet" or an overnight solution. It takes hard work and a partnership over some time to help increase the chances for success. Without such a program, I fear our industry, the aftermarket, and the reseller community will continue to experience declining revenues and profitability.