The market shares between OEM and aftermarket have been unchanged for many years. In this blog, the sixth in a multi-part series, I will explain the ink and toner product life cycle and the consumer adoption curve related to aftermarket alternatives. You're going to learn that the stagnation of the aftermarket proposition is mainly associated with OEM blocking strategies and not with the lack of consumer acceptance of the aftermarket value proposition.

The Aftermarket, Office Supplies, and a Major Tipping Point Series

The OEM Mergers Endgame (Part II)

The Aftermarket Manufacturer's Mergers Endgame (Part III)

The Reseller's Mergers Endgame (Part IV)

Summary - The Mergers Endgame (Part V)

The Five Steps of the Consumer Adoption Process

- Product Awareness

- Product Interest

- Evaluation

- Trial

- Adoption / Rejection

The Five Stages of Consumer Adoption

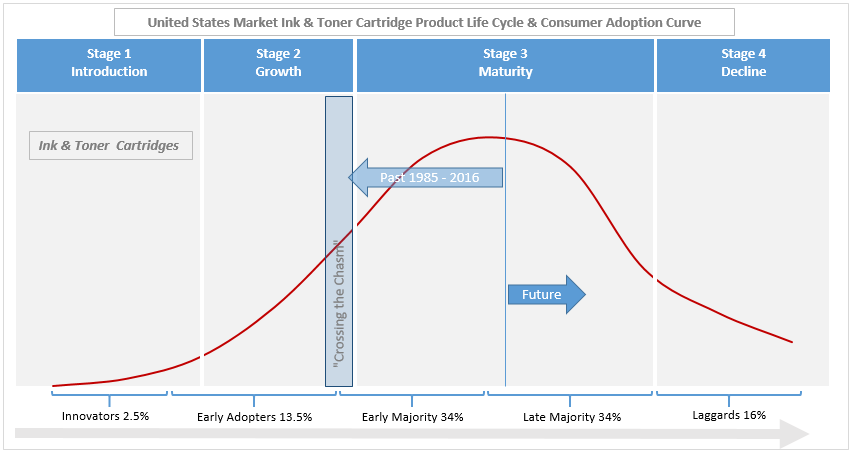

Consumer adopter distributions follow a bell-shaped curve over time that can be divided into five categories:

Innovators (2.5%) - a small group of people eager to try new ideas and take risks

Early Adopters (13.5%) - individuals respected by their peers and with a reputation for the successful use of new ideas

Early Majority (34%) - seldom leaders take more time to deliberate before being willing to adopt a new idea

Late Majority (34%) - skeptics only willing to adopt a new idea after the average adopter has already done so

Laggards (16%) - traditionalists, the last to adopt an innovation and maybe after it's already obsolete

Regarding office printing and ink and laser supplies, we're in a late-stage, mature industry. Laser printing emerged in the mid-1980s, and ink arrived a little later, during the early 1990s. The aftermarket remanufacturing sector was born in the mid to late 1980s; the innovator and early adopter consumers quickly propelled the aftermarket remanufactured cartridges to a 20% share by the mid-1990s and 30% by the end of the millennium. With a far smaller percentage of the color market (less than 10%), aggregate aftermarket share has stagnated at around 20% ever since!

Regarding office printing and ink and laser supplies, we're in a late-stage, mature industry. Laser printing emerged in the mid-1980s, and ink arrived a little later, during the early 1990s. The aftermarket remanufacturing sector was born in the mid to late 1980s; the innovator and early adopter consumers quickly propelled the aftermarket remanufactured cartridges to a 20% share by the mid-1990s and 30% by the end of the millennium. With a far smaller percentage of the color market (less than 10%), aggregate aftermarket share has stagnated at around 20% ever since!

To progress this far, all five stages of the Consumer Adoption Process were satisfied - product awareness, consumer interest, evaluation, trial, and adoption. Furthermore, all these thresholds were crossed during the 1990s despite the products being technically inferior to the OEM versions. With a 30% market share (on monochrome laser) by 2000, consumer adoption was deep into the early majority stage and had "crossed the chasm" of consumer acceptance. According to consumer adoption theory, the aftermarket alternatives should have expanded to broader market acceptance and market share growth.

Now, at this point, it would be easy to get bogged down in a narrative of ink versus laser and monochrome versus color printing. We all know the aftermarket has faced many technical challenges within these categories that may have affected progress along the consumer adoption curve. It's not difficult to argue that the five stages of the consumer adoption process were not satisfied (for example) within the color laser printing sub-category and that the process broke down at stage five as products were rejected because they failed to meet consumer expectations. However, aftermarket monochrome products were adopted despite their technical inferiority, so why not color? What else changed that prevented consumer adoption from continuing to develop?

The OEM wake-up call

I doubt the OEMs ever imagined a bunch of entrepreneurs would come up with a means to recover and remanufacture their original cartridges. They were confident their government-granted monopolies (by way of thousands of patents) would ensure no loss of market share. So, they did what all monopolists do: exert their power (in this case, over the resellers), charge high prices for the cartridges, and enforce strict terms for continuing to allow them to buy and resell them.

However, the resellers didn't like being dictated to, so they gave the aftermarket remanufacturers a break by providing a distribution outlet for their cartridges. As a result, consumers became aware of the cheaper alternatives, expressed interest, and quickly adopted the lower-priced cartridges, despite their inferior technical performance.

The OEM's "wake-up" call led them to understand the aftermarket represented a severe long-term threat to their business model. The OEMs have always had a go-to-market business dilemma - they have to price the printers low enough for mass adoption and then sell the cartridges at a high enough price to subsidize the losses incurred developing the installed base. If a significant market share loss on the cartridges occurs, the business model collapses.

These developments led to the introduction and fine-tuning of numerous blocking tactics to restrict the aftermarket from taking share.

The OEM Blocking Tactics

Rebates:

The first and most effective blocking strategy was the continued deployment and fine-tuning of the rebate model. By introducing sales quotas for their approved distributors and tying their quarterly rebate checks to performance against that quota, the OEMs can effectively control market share through the big-box retailers and other Tier-1 distributors and resellers. In leveraging their knowledge that the reseller's sales compensation plans are usually based on the top-line (i.e., $100 OEM cartridges) and that investors and the financial community typically react favorably to top-line growth, they knew they could significantly restrict the impact of aftermarket cartridges. Remember, this has nothing to do with customer acceptance of the aftermarket cartridges; this results from influential OEMs exerting influence over the resellers to restrict consumer access to alternatives.

Think about this: has the aftermarket share of color been restricted to 8% or so for the last decade because of poor quality products or OEM sales quotas and rebate incentives?

Industry Consolidation:

As the big-box retailers, Tier-1 resellers, and aftermarket manufacturers have consolidated, it's played directly into the hands of the OEMs and their blocking strategies. It's far more accessible for OEMs to exert influence over smaller enterprises than a larger, more diverse group of resellers and competitive manufacturers. At first glance, you may think the more significant a reseller of OEM products becomes, the more powerful it becomes and should, therefore, exert more influence over the OEMs. However, this is not the case. The resellers all dance to the tune of the OEMs, taking the easy option for top-line sales over profit-maximizing alternatives (i.e., aftermarket cartridges).

Control of Distribution:

During 2012-14, HP cut a reported 10,000 resellers off their products and imposed strict reporting requirements on its remaining authorized distributors, including writing to whom they were selling HP brand products. Imagine telling your supplier who your customers are, especially when they're already selling directly to consumers and bypassing distribution in some markets. Now, a manufacturer is entitled to set the terms for resellers of its products. Hence, HPHP's not inherently wrong with doing what it did, but let's look for an underlying strategy behind these tactics.

HP already had all the sales, so did it matter that many resellers were small businesses and perhaps of little importance to HP? Did they negatively impact as HP seemed to imply and, as a result, not deserve the right,t to resell HP's products? Or, did HP consider it necessary to weaken these resellers by denying them access to their products because they represented a potential future threat to their business model? Unlike the Tier-1 retailers and resellers, HP could not control the smaller independents with rebate dollars - someone who sold $50,000 of HP products per year and got maybe two or three thousand back in rebates - it just wasn't enough money for HP to impose a controlling strategy.

Core Recovery:

How to restrict aftermarket share? Well, start competing for the cores. The aftermarket set up vast core recovery programs during the 2000s, providing the raw materials for growth, so the leading OEMs followed suit. By reducing the number of cores in the supply chain available to the remanufactured, they developed another powerful weapon to restrict the development of the aftermarket share.

Engine Diversity:

Never again would the OEMs make the same mistake and allow a single "engine" to develop a large installed base as they did with the original "SX" engine in the late 1980s and early 1990s. Today's life cycle for hardware is drastically reduced, with new models coming out quicker. It takes time, research, and development expense for the aftermarket to develop new products; it takes time to recover enough cores to place a new product in distribution and ensure there are good cores to keep it stocked in distribution. There's risk involved for the aftermarket to determine whether a new product announcement from the OEM will be successful or not and whether they should devote their efforts to developing an aftermarket alternative. The more recent products launched by the OEM, the higher these aftermarket expenses and risks become. In the early days, ten products covered 80% of the market; now, it takes hundreds of products to cover 80%.

Cartridge Technology:

There's a lot of technology on an ink or laser cartridge these days, and you have to ask yourself, is all this necessary, or is it a tactic to thwart the aftermarket from gaining market share? Starting with Seiko Epson on their ink cartridges in the early 2000s, and continuing at an increasingly rapid pace, has been the placement of encrypted chips on almost every OEM cartridge that comes to market. It's difficult to accept that every feature incorporated into these chips has been developed to improve the experience as opposed to bloc instead aftermarket cartridges.

Simply being able to plant a firmware update on their hardware that temporarily or permanently turns off aftermarket cartridges carries far more potential to erode consumer confidence than any conventional brand marketing can achieve.

Legal:

The constant threat of patent infringement, the seeking of ITC General Exclusion Orders to restrict imports, and the bringing of the First-Sale Doctrine into play and placing a heavy cloud over remanufacturers about the responsibility for knowing the core used for remanufacturing was sourced from the United States market after a legitimate "first-sale" in that same market.

Perhaps, the OEMs can watch the aftermarket resellers contribute to their downfall by selectively ignoring potentially infringing and potentially counterfeit products sold through channels such as online marketplaces like Amazon and eBay. With the Tier-2 and Tier-3 resellers desperately trying to figure out e-commerce and flooding these marketplaces with low-priced products, what better way for the aftermarket to erode its reputation for quality while simultaneously playing directly into the OEM's marketing strategy to discredit lower-priced alternatives?

Traditional Marketing:

There's a word out there known as "FUD" - it means fear, uncertainty & doubt and is usually invoked intentionally to put a competitor at a disadvantage. OEM FUD campaigns have been aggressively deployed since the aftermarket first appeared.

Below are links to four FUD campaigns launched by Hewlett-Packard. Please take a look and decide whether these are dragging up memories of toner bombs and other quality issues from twenty years ago or whether they legitimately apply to the products available from the top-tier aftermarket manufacturers and remanufacturers that exist today.

As you're considering whether these FUD campaign videos apply to today's market, also believe that the OEMs already sell the exceptional aftermarket products they denigrate in their marketing collateral. They have to support their MPS programs.

They sell managed print service contracts to their most significant, their very best, premium customers who may have thousands of printers deployed throughout their organizations. These printer fleets are always made up of various OEM hardware - i.e., there may be HP, Lexmark, Oki, Kyocera Mita devices, etc. When these OEMs prepare a multi-year managed print services contract, who do they turn to for cartridges to fit on these devices? Well, you can be sure it's not their OEM competitors. HP is not going to Lexmark, and Lexmark is not going to HP, for cartridges to fit into the devices they need to service, so they go to Clover or LMI Solutions and source aftermarket cartridges - the same cartridges they would prefer to have everyone believe are technically inferior and unsuitable for consumers to use!

This is the ultimate hypocrisy in "do as I say, not as I do!"

Logistics & Customer Service:

The OEMs, the big-box retailers, the Tier-1 resellers and distributors, and the Tier-1 aftermarket remanufacturers have all done a great job in logistics and customer service. All have invested heavily in information technology to ensure they can deliver quickly, reliably, and cost-effectively. All have invested in state-of-the-art customer response systems (CRM) to promptly and efficiently pull up customer history and records for purchasing patterns and problem resolution. The Tier-2 and Tier-3 resellers have allowed their larger competitors to get ahead in this crucial aspect of modern-day business, and, of course, it has now become part of the overall blocking strategy.

Blocking Tactics - Conclusions:

It's difficult not to be impressed with this long list of defensive strategies the OEMs have deployed. For sure, they are challenging, intelligent competitors. They know their competition and how to neutralize the market players to achieve their goals. The OEM blocking strategies and communications have been so effective that I think even the resellers of aftermarket products have come to believe its negative messaging!

This blog is about the consumer adoption curve and product life cycles, but I've only spent a little time specifically on this topic. However, the reason for this is that the aftermarket ink and toner cartridges have already been through the first stages of the adoption curve, successfully reaching the "early majority" stage and even "crossing the chasm" toward greater adoption. Consumer interest and adoption are not the issues here; it's the story of how and why, despite the consumer interest, the path to a more significant share of the overall market has been blocked.

The fact that consumers have already demonstrated a willingness to adopt the aftermarket value proposition must not be underestimated. Knowing this is a massive advantage for independent resellers who want to restart their business development. The challenge is not whether customers wish to buy the products; it's figuring out effective ways to circumvent the OEM roadblocks and increase market share.

What next?

Well, it's time for the aftermarket to fight back.

Today's quality of the aftermarket product proposition compared to when it passed those first critical consumer acceptance thresholds in the 1990s is simply night and day. However, with the big, influential retailers and resellers firmly in the pocket of the OEMs, there's been no practical path to get the aftermarket message to consumers and to educate them on the value proposition and the availability of these quality alternatives. Remember, this was not the case when the resellers in the 1990s gave the aftermarket industry a break, putting their products into the distribution channels and allowing consumers to become aware of and adopt them.

In the next blog in this series, I'll present my view on where the battlegrounds will be and what tactics may be utilized in the fight for market share. The success of many OEM blocking tactics depends on the existing cartel arrangement (big-box retailers, Tier-1 resellers and distributors, and the Tier-1 aftermarket manufacturers) being preserved. Sure, one of the big guys could break ranks and influence change, but I think that's unlikely.

I will focus on the Tier-2 and Tier-3 resellers and distributors, with whom the OEMs have little influence over their business. In conjunction with the newly emerging Chinese superpower manufacturers of high-quality new-build compatibles, that's a new partnership with the potential to carry on where those early pioneers of the aftermarket for ink and toner started.