Most industries experience consolidation - there are few exceptions, and the office products and supplies industry is certainly not one of them. In this blog, the fifth in a multi-part series, I will summarize the office products and supplies mergers endgame that we've been examining in some detail in Parts II, III, & IV of this series.

The Aftermarket, Office Supplies, and a Major Tipping Point (Part I) - The Tipping Point

The Aftermarket, Office Supplies, and a Major Tipping Point (Part II) - The OEM Endgame

The Aftermarket, Office Supplies and a Major Tipping Point (Part IV) - The Reseller's Endgame

As were already established, there are three segments of the office products industry to assess to examine the mergers endgame;

1. The OEMs (Examined in Part II)

2. The Aftermarket Manufacturers (Examined in Part III)

3. The Reseller's (Examined in Part IV)

The Manufacturer's

There's already a crossover between the OEM and aftermarket manufacturing sectors with Ninestar / Apex Technologies acquiring Lexmark, so I think it makes sense to summarize the manufacturing consolidation as one segment.

The video clip below contains an animation illustrating a potential outcome of the manufacturer's merger endgame that could take place over the next few years. Of course, I don't have a crystal ball, so it'll be interesting to see each of the upcoming events and how each affects future thinking versus the current projection.

Who would have thought Apex would acquire Lexmark, and who would have thought HP would be developing Samsung's Printer Business? So far as my thinking was concerned, both deals came out of left field. So, the structure of the fully consolidated industry, as projected in this animation, may be no more than educated speculation. Still, it's a format that will be updated after each event does take place and will help us to project the outcome well in advance, as the various currently possible options are eliminated one by one.

It's challenging to see Xerox surviving as an independent enterprise in the final stages of the consolidation. We've already seen Lexmark and Samsung throw in the towel, and a similar outcome may be expected for Xerox. However, any deal, as I've speculated, with HP as an acquirer would be likely to be closely scrutinized by the FTC, and the outcome is by no means assured. If HP cannot acquire Xerox for anti-competitive reasons, look to Canon potentially stepping in.

Of course, I don't know the actual five or six names that may eventually be heading up the fully consolidated industry I've projected, but, in short, I believe that's about the final number of enterprises that will be left standing after the endgame. Subject to the thinking of the Fair Trade Commission in Japan, it's not unreasonable to speculate that their industry may consolidate into two main segments - the A3 players and the A4 players, with perhaps Canon remaining as a standalone.

For the aftermarket manufacturers, although it's likely the Chinese will dominate the endgame, I'm hoping there will be three significant entities left standing. Ninestar is a Hubei Dinglong / SGT combination and a Clover, Print-Rite, Turbon, and LMI combination. However, Clover may decide not to stick around for the endgame, so it could look quite different from my current projection, with only one or two Chinese entities left to represent the global aftermarket interests.

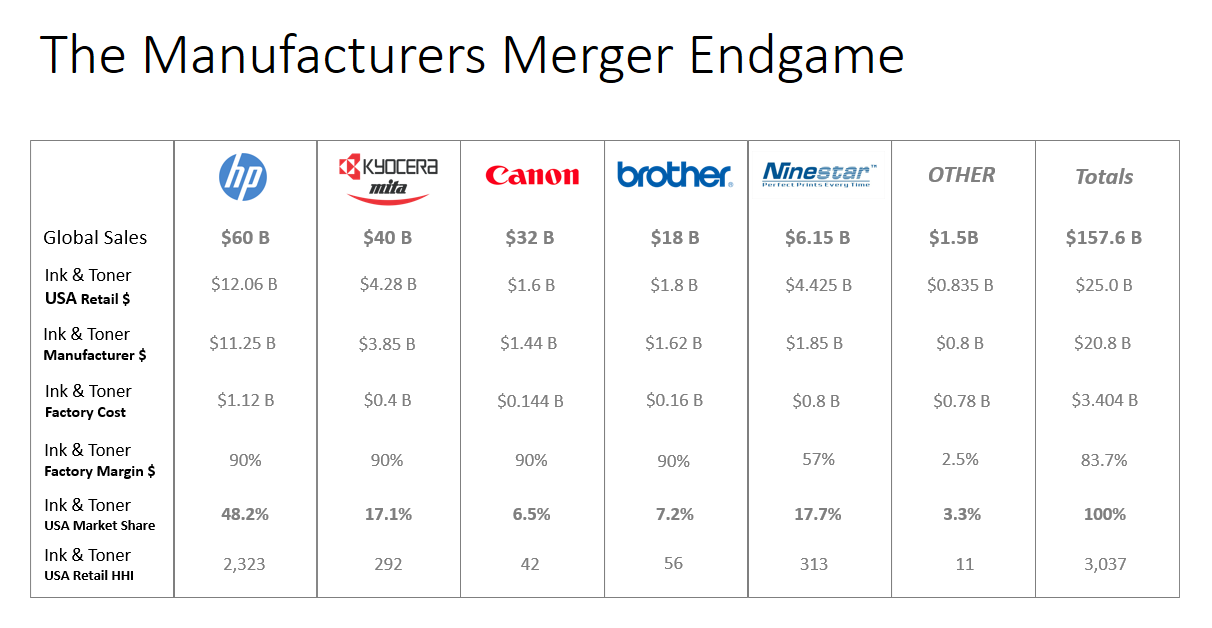

As is shown in the table below, a handful of global manufacturers with combined annual sales of nearly $160 billion, a CR3 of 83%, and an HHI of 2,500+ spells out an industry defined as highly concentrated with potentially monopolistic power. One country and government agency would most likely not permit such a consolidation. However, multiple countries and government agencies assessing mergers and acquisitions in light of their markets, not a single global market, may allow their consolidations to occur.

Footnotes to the table:

Footnotes to the table:

The company name at the head of each column is used for illustrative purposes. While we believe the Japanese A3 and A4 enterprises could consolidate in this manner, we have no way of knowing that either Kyocera Mita or Brother may be the leaders in such an initiative.

To simplify, we have grouped all the major aftermarket manufacturers under the Ninestar banner rather than attempting to further crowd the table with three separate entities: Ninestar, Hubei Dinglong, and the Clover Imaging Group.

In drilling down to evaluate just the ink and toner segment (2016 U.S. market size of $25 billion in retail dollars), and as would be supplied by these five or six enterprises, the market would be even more concentrated albeit with a slightly lower CR3 of 72% but with an HHI of over 3,000.

I believe the margin dollars on imaging supplies are one of the critical drivers of the consolidation in the industry. The strongest manufacturers will only participate in the mergers endgame if they believe they can protect the existing business model and the high margins earned from the supplies. Of course, merging two large organizations leads to synergies that may be vigorously extracted, but ink and toner are the crown jewels for future profits.

This is important for an independent reseller to understand because the days of $100 OEM brand cartridges will not go away anytime soon. Even if the overall market for office products and, in particular, ink and toner is entering a slow decline of 1% or so per year, then it will remain a large market for the foreseeable future, with plenty of growth opportunity for savvy reseller's attacking the top-end of the market.

I'll be going on to discuss the Consumer Adoption Curve (as it relates to aftermarket ink and toner cartridges) and the location of the expected battlegrounds for market share in the following two blogs in this series, so I'm not going any deeper into these. Suffice it to say; these subjects should be of most interest to independent resellers looking for growth and opportunity over the next decade and (once they have a solid understanding of the market opportunity) just why it will be around for the foreseeable future.

The Reseller's

As was explained in Part IV of this series, at the broadest level, the reselling sector of the industry in the United States is not concentrated and remains very competitive. However, what we learned in May 2016 is that the FTC in the United States would not allow the merger of the two biggest resellers, Staples and Office Depot, after they narrowly defined the market for office supplies (excluding ink and toner) in the B2B segment and determined the merged entities would have monopolistic power. Despite the failure of the proposed acquisition, I don't believe this means either Staples or Office Depot is off the table in terms of future M&A activity - just not with each other.

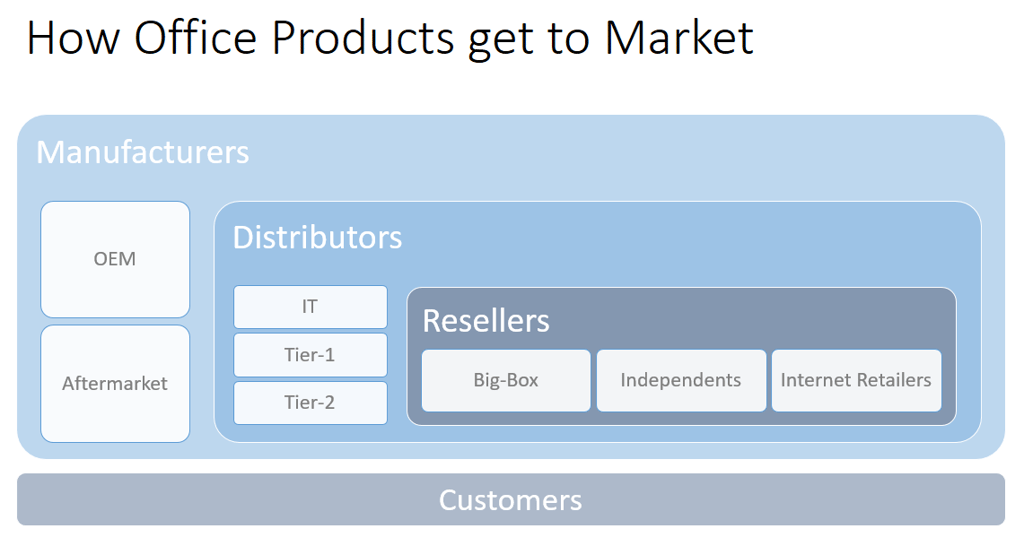

I think the outlook for the mergers endgame and the resellers in the United States needs to be considered in the context of the emergence of the three Chinese aftermarket superpowers (Ninestar, Hubei Dinglong, and Suzhou Goldengreen Technology) and their probable desire to increase market share for their products in the United States. With Ninestar's 2015 acquisition of Static Control and SGT's acquisition of Cartridge World, we've already seen evidence that the Chinese will acquire U.S. companies with distribution relationships that will further their goal to increase market share. We haven't explicitly talked about it before. Still, China-based Han Group is finally closing its deal to acquire Ingram Micro, a major Information Technology distributor, for over $6 billion. Ingram is a significant player in the distribution of OEM ink and toner cartridges, and it may not be beyond the realms of possibility that one or more of the Chinese aftermarket superpowers are already talking to Han Group about the chances of placing Chinese products into distribution through Ingram Micro.

I think the outlook for the mergers endgame and the resellers in the United States needs to be considered in the context of the emergence of the three Chinese aftermarket superpowers (Ninestar, Hubei Dinglong, and Suzhou Goldengreen Technology) and their probable desire to increase market share for their products in the United States. With Ninestar's 2015 acquisition of Static Control and SGT's acquisition of Cartridge World, we've already seen evidence that the Chinese will acquire U.S. companies with distribution relationships that will further their goal to increase market share. We haven't explicitly talked about it before. Still, China-based Han Group is finally closing its deal to acquire Ingram Micro, a major Information Technology distributor, for over $6 billion. Ingram is a significant player in the distribution of OEM ink and toner cartridges, and it may not be beyond the realms of possibility that one or more of the Chinese aftermarket superpowers are already talking to Han Group about the chances of placing Chinese products into distribution through Ingram Micro.

In this context, consider the Chinese potentially acquiring either Depot or Staples. I'm not suggesting that an aftermarket manufacturer such as Ninestar or Hubei Dinglong would go in this direction. Still, the Han Group or other similar Chinese investors may be interested. Regardless of who it may be (if anyone), you can imagine the likelihood of leveraging relationships to help distribute Chinese products through their new owners. Events of this nature can completely change how we've become accustomed to the existing "cartel" of OEMs, Tier-1 remanufacturers, and Tier-1 resellers.

Regardless, even if an event of this nature was to take place, I still don't see much likelihood of the existing Tier-1 reseller's pricing model (forced upon them by the OEMs and adopted by them for the aftermarket alternatives) will change. A Chinese investor acquiring (for example, Office Depot) would not want to see that investment potentially compromised with radical strategies resulting from increased aftermarket cartridge sales at the expense of OEM. Loss of the OEM rebates for failing to achieve pre-determined sales quotas would be a risky strategy, particularly as Staples (in this case) would be well positioned to compete for accounts potentially compromised within an aggressive "OEM to aftermarket" conversion strategy.

So, just like the endgame for the manufacturers is not likely to disrupt the existing cartel arrangements for pricing and market shares, I believe the same is true for the mergers endgame for the Tier-1 resellers. Knowing this to be the case should provide significant reassurance to the Tier-2 resellers of office products that, looking "up" to the "Blue Ocean" of Office Depot and Staples customers and competing for that business, rather than looking "down" to the "Red Ocean" of the dog-eat-dog internet based e-commerce marketplaces, will be a significant growth opportunity for many years to come. Again, we'll explore this opportunity in the two upcoming blogs in this series that deal with the Consumer Acceptance Curve as it may pertain to the supply of aftermarket ink and toner and then to the battlegrounds we expect the fight for market share to take place in.

I can't finish this section on the reseller's merger endgame without a mention of Amazon. Although I'll cover their possibly disruptive role in my upcoming blog dealing with the battlegrounds for market share, they could enter the merger's endgame with an acquisition of either Office Depot or Staples. However, I think such a wildcard move would test how serious Amazon is about this category, as it would represent a significant shift from its existing growth strategy and involve considerable risks. For now, I'll put an event of this nature low on the probability charts, but don't forget I didn't see Ninestar acquiring Lexmark or HP acquiring Samsung, either!

This link contains adult material. By clicking, you confirm you are 18+ and agree to our Terms.

<a href=https://punishmentsupport.com/b9i7cp48?key=a92fec12b68d4b88909a4408cc9aa3b7>Penetrate</a>

‼️LIMITED-TIME DEAL: ChatGPT PLUS/PRO at the LOWEST PRICE online!‼️

GRAB YOUR SUBSCRIPTION NOW: ❣️ <a href=https://bit.ly/UNLOCK-ChatGPT-PRO>ChatGPT PLUS/PRO</a> ❣️

✅ WHY CHOOSE US?

✔ Instant activation – No waiting!

✔ Official subscription – No risk of bans!

✔ Cheaper than OpenAI’s website!

✔ Thousands of happy customers & 5-star reviews!

✔ 24/7 support – We’re here to help!

✅ HOW TO ORDER? (FAST & EASY!)

1️⃣ Click the link & select your plan.

2️⃣ Pay securely (Crypto, PayPal, Cards, etc.).

3️⃣ Receive your login OR unique activation code instantly!

4️⃣ Enjoy ChatGPT PLUS/PRO in minutes!

✅ WHAT’S INCLUDED?

⭐ GPT-4o (Fastest & Smartest AI!)

⭐ GPT-4 Turbo (Longer, detailed answers!)

⭐ Advanced AI features (Code Interpreter, Plugins, File Uploads!)

⭐ Priority access – No more downtime!

⚠ DON’T PAY FULL PRICE! Get ChatGPT PRO cheaper HERE:

❣️ <a href=https://bit.ly/UNLOCK-ChatGPT-PRO>ChatGPT PLUS/PRO</a> ❣️

⏳ DEAL ENDS SOON! Prices are rising—CLAIM YOUR SPOT NOW!

GRAB YOUR SUBSCRIPTION NOW: ❣️ <a href=https://bit.ly/UNLOCK-ChatGPT-PRO>ChatGPT PLUS/PRO</a> ❣️

✅ WHY CHOOSE US?

✔ Instant activation – No waiting!

✔ Official subscription – No risk of bans!

✔ Cheaper than OpenAI’s website!

✔ Thousands of happy customers & 5-star reviews!

✔ 24/7 support – We’re here to help!

✅ HOW TO ORDER? (FAST & EASY!)

1️⃣ Click the link & select your plan.

2️⃣ Pay securely (Crypto, PayPal, Cards, etc.).

3️⃣ Receive your login OR unique activation code instantly!

4️⃣ Enjoy ChatGPT PLUS/PRO in minutes!

✅ WHAT’S INCLUDED?

⭐ GPT-4o (Fastest & Smartest AI!)

⭐ GPT-4 Turbo (Longer, detailed answers!)

⭐ Advanced AI features (Code Interpreter, Plugins, File Uploads!)

⭐ Priority access – No more downtime!

⚠ DON’T PAY FULL PRICE! Get ChatGPT PRO cheaper HERE:

❣️ <a href=https://bit.ly/UNLOCK-ChatGPT-PRO>ChatGPT PLUS/PRO</a> ❣️

⏳ DEAL ENDS SOON! Prices are rising—CLAIM YOUR SPOT NOW!

GRAB YOUR SUBSCRIPTION NOW: ❣️ <a href=https://bit.ly/UNLOCK-ChatGPT-PRO>ChatGPT PLUS/PRO</a> ❣️

✅ WHY CHOOSE US?

✔ Instant activation – No waiting!

✔ Official subscription – No risk of bans!

✔ Cheaper than OpenAI’s website!

✔ Thousands of happy customers & 5-star reviews!

✔ 24/7 support – We’re here to help!

✅ HOW TO ORDER? (FAST & EASY!)

1️⃣ Click the link & select your plan.

2️⃣ Pay securely (Crypto, PayPal, Cards, etc.).

3️⃣ Receive your login OR unique activation code instantly!

4️⃣ Enjoy ChatGPT PLUS/PRO in minutes!

✅ WHAT’S INCLUDED?

⭐ GPT-4o (Fastest & Smartest AI!)

⭐ GPT-4 Turbo (Longer, detailed answers!)

⭐ Advanced AI features (Code Interpreter, Plugins, File Uploads!)

⭐ Priority access – No more downtime!

⚠ DON’T PAY FULL PRICE! Get ChatGPT PRO cheaper HERE:

❣️ <a href=https://bit.ly/UNLOCK-ChatGPT-PRO>ChatGPT PLUS/PRO</a> ❣️

⏳ DEAL ENDS SOON! Prices are rising—CLAIM YOUR SPOT NOW!