Most industries experience consolidation - there are few exceptions, and the office products and supplies industry is certainly not one of them. In this blog, the fourth in a multi-part series, I will explore some scenarios for the reseller's merger endgame and the impact this may have on the future of the aftermarket for office products and supplies and the independent resellers.

The Aftermarket, Office Supplies, and a Major Tipping Point (Part I) - The Tipping Point

The Aftermarket, Office Supplies, and a Major Tipping Point (Part II) - The OEM Endgame

There are three segments of the office products industry to assess when examining the mergers endgame;

1. The OEMs (Examined in Part II)

2. The Aftermarket Manufacturers (Examined in Part III)

3. The Resellers (The Subject of this Part IV)

The Resellers

There are many resellers of office products and supplies. At first sight, most observers would automatically assume it's a very competitive and diversified reselling environment.

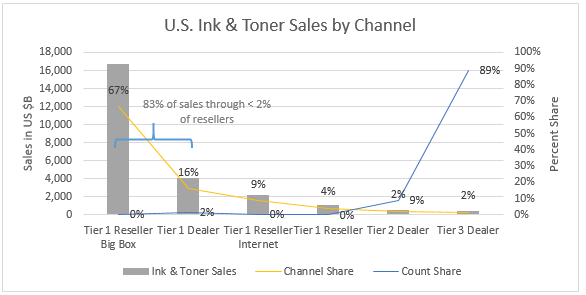

In fact, by our estimate, there are well over 5,000 resellers in the United States alone. However, on a closer look, as demonstrated in the chart below, 83% of the estimated $25B in U.S. ink and toner retail sales are conducted by less than 2% of the total resellers.

To develop an understanding of the reseller's potential merger endgame, two events are of particular interest to us. Firstly, the busted Staples and Office Depot acquisition and, secondly, (very much related) the definition of the market as may be determined by government authorities to decide whether or not a proposed investment should be allowed. Understanding these will help to understand better what may happen in the future.

There have been many studies surrounding the characteristics of industries over time, but it's generally accepted that there will be consolidation in most industries, and market concentration will develop. To measure how concentrated an industry is, two calculations are widely used by Fair Trade Authorities, such as the FTC, in determining whether or not proposed acquisitions should be allowed to proceed.

1. The Concentration Ratio (CR) is calculated by adding the percentage share of the largest enterprises in the particular market or industry. Usually, the top three are used (hence the label CR3), so, for example, if the top three companies have a 50% share, then the CR3 = 50%.

2. The Herfindahl-Hirschman Index (HHI) is calculated by squaring the market share of all competitors and summing the total. For example, if the leading enterprise has a market share of 25%, then 25 x 25 = 625; if the next most significant player has a share of 15%, then 15 x 15 = 225, a running total of 850, and so on until all market participants are accounted for.

The highest value for the index would be if there were a pure monopoly - i.e., one enterprise with 100% market share or 100 x 100 = 10,000. The opposite end of the scale would be pure competition, for example, 10,000 competitors each with one-hundredth of one-percent market share - i.e. (.01 x .01) = 0.0001 x 10,000 = 1.

With that brief foundation, let's look at the resellers in the office products and supplies space.

There are four scenarios shown in the following four tables. Scenarios One and Three explain a pre-merger and post-merger market for Office Products and Supplies. In contrast, Scenarios Two and Four describe a pre-merger and post-merger market for Office Supplies (ink and toner only).

Scenario 1 - Let's look at this concept from the perspective of the United States market for all office products and supplies (estimated at an $85 billion annual market) regarding the shares held by the various resellers in the different reselling channels.

| Channel | Count | Total Sales ($M) | Share % | HI |

| Tier-1 Reseller Big-Box | 9 | $67,450 | 66.7% | 946 |

| Tier-1 Dealer | 100 | $7,364 | 16.2% | 4 |

| Tier-1 Reseller (Internet) | 4 | $6,625 | 8.9% | 31 |

| Tier-1 Reseller | 2 | $1,900 | 4.2% | 12 |

| Tier-2 Dealer | 500 | $1,090 | 2.4% | 0 |

| Tier-3 Dealer | 5,000 | $750 | 1.6% | 0 |

| Grand Total | 5,615 | $85,179 | 100% | 993 |

Scenario 2 - Now let's look at the same concept with a narrower definition of the market - i.e., the United States resellers market for ink and toner (excluding all other office products) and widely estimated as a $25 billion annual retail market.

| Channel | Count | Total Sales ($M) | Share % | HI |

| Tier-1 Reseller Big-Box | 9 | $16,674 | 79.2% | 1,311 |

| Tier-1 Dealer | 100 | $4,050 | 8.6% | 1 |

| Tier-1 Reseller (Internet) | 4 | $2,219 | 7.8% | 20 |

| Tier-1 Reseller | 2 | $1,045 | 2.2% | 3 |

| Tier-2 Dealer | 500 | $599 | 1.3% | 0 |

| Tier-3 Dealer | 5,000 | $412 | 0.9% | 0 |

| Grand Total | 5,615 | $25,000 | 100% | 1,355 |

Look at the difference between Table 1 and Table 2 regarding the two key measurements, market share concentration, and the HHI index! By narrowing the definition of the market from all office products to just that of the market for ink and toner, we can see that the most effective sales channel controls nearly 80% of ink and toner sales, with an overall HHI of 1,355.

By definition, the FTC would define the overall office products market as "not concentrated" (HHI = less than 1,000), but the market for ink and toner as "moderately concentrated" (HHI is between 1,000 and 1,799).

Scenario 3 - Now let's look at the same two scenarios already summarized in Table 1 and Table 2, but assume that Staples had successfully acquired Office Depot.

| Channel | Count | Total Sales ($M) | Share % | HI |

| Tier-1 Reseller Big-Box | 8 | $67,450 | 66.7% | 1,631 |

| Tier-1 Dealer | 100 | $7,364 | 16.2% | 4 |

| Tier-1 Reseller (Internet) | 4 | $6,625 | 8.9% | 31 |

| Tier-1 Reseller | 2 | $1,900 | 4.2% | 12 |

| Tier-2 Dealer | 500 | $1,090 | 2.4% | 0 |

| Tier-3 Dealer | 5,000 | $750 | 1.6% | 0 |

| Grand Total | 5,615 | $85,179 | 100% | 1,677 |

I've highlighted the cells in Tables 1 and 3 that have changed - in Table 1, they're green, and in Table 3, they're red.

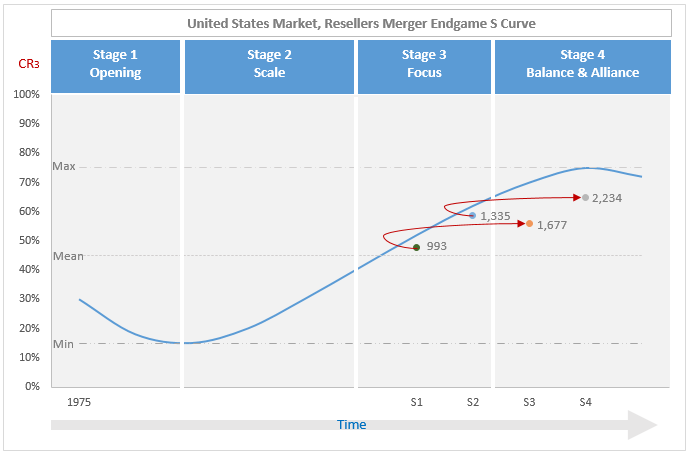

One big-box enterprise is eliminated as Office Depot is merged with Staples. Overall the reseller count drops from nine to eight; the HHI score increases from 993 to 1,677. This is still within the FTC boundaries of a "moderately concentrated" industry but is a significant increase (684) from the pre-merger index score and approaching the threshold for being judged as a "highly concentrated" industry.

Scenario 4 - Now let's look at the final Table 4 and compare the more narrowly defined market for ink and toner before and after Staples's planned acquisition of Office Depot.

| Channel | Count | Total Sales ($M) | Share % | HI |

| Tier-1 Reseller Big-Box | 8 | $16,674 | 79.2% | 2,234 |

| Tier-1 Dealer | 100 | $4,050 | 8.6% | 1 |

| Tier-1 Reseller (Internet) | 4 | $2,219 | 7.8% | 20 |

| Tier-1 Reseller | 2 | $1,045 | 2.2% | 3 |

| Tier-2 Dealer | 500 | $599 | 1.3% | 0 |

| Tier-3 Dealer | 5,000 | $412 | 0.9% | 0 |

| Grand Total | 5,615 | $25,000 | 100% | 2,234 |

Once again, I've highlighted the cells that changed. In Table 2, they're green; in Table 4, they're red. One big-box enterprise has been eliminated as Office Depot is merged with Staples, and the reseller count drops from nine to eight. The HHI score increases from 1,355 to 2,234, and the defined market now becomes a "highly concentrated" industry with a substantial increase of 879 index points resulting from the proposed acquisition event.

Had the FTC used the ink and toner market to assess whetherples should have been permitted to acquire Office Depot? I don't think the outcome would have differed, as their objections would have likely been similar. As it was, the FTC used the market for office products (excluding ink and toner). It further narrowed the need to argue that the Staples / Depot merged entity would have had monopolistic power in the B2B contract stationery sector. Staples failed to provide a counter-argument to the FTC's position and ultimately withdrew from the deal.

The four scenarios I've explained above are plotted on the Industry Consolidation Curve below. This helps demonstrate what the FTC was concerned about regarding Staples proposed acquisition of Office Depot and the progression toward increased market concentration and reduced competition.

The Big Box Retailers - Staples and Office Depot

During the 15-month failed acquisition process, Staples made it clear that they feared the increasing threat posed by Amazon while also claiming there was significant competition from all the other traditional office products and supplies resellers. While competition from resellers such as CDW, Insight, Walmart, Target, Costco, Sam's, and even the OEMs is unarguable, the Court accepted the FTC's argument that the threat from Amazon in the B2B contract stationary market was in the future, not the present. It was, therefore, irrelevant to the proceedings.

The B2B contract stationery business conducted by Staples and Office Depot is the "crown jewels" of these two big-box resellers.

As we know, neither Staples nor Depot can shrink their "brick and mortar" retail footprint fast enough to accommodate consumers changed buying habits. Walk-in retail is threatened by changing consumer purchasing habits, not specifically by Amazon.

Staples and Office Depot have powerful e-commerce platforms to compete with Amazon.

We know Amazon has a renewed focus on its Business Services initiative, relaunched back in April 2015, and it is this threat that probably keeps the Staples and Depot executives awake at night.

However, while this may become a significant threat in the future, the difficulty for Amazon is their expertise is more geared to B2C than B2B, and a B2C solution is not what B2B customers are generally looking for.

There's a high level of integration between Staples / Depot and their B2B customers that Amazon cannot currently match. At least for now Amazon will most likely continue to find it quite difficult to win substantial portions of this B2B business.

When looking at the financial indicators for Staples and Office Depot, it's clear that Office Depot is the weaker of the two entities. However, they're hardly distressed, announcing better-than-expected earnings in November 2016 and the sell-off of their European and other overseas operations. This indicates they are gearing up for a focused U.S. strategy and increasingly cost-efficient operations.

As a result of its failed acquisition, Staples had to pay Depot a $250 million breakup fee. While both Depot and Staples are trading close to book value, Depot has informed its shareholders it's authorized to spend up to 100% of that breakup fee buying back its shares.

If the leadership at Depot doesn't believe in its future, then it wouldn't be likely to spend this windfall on a buy-back of its shares.

The Depot can continue to finance closing their traditional twenty-five thousand square foot stores out of cash flow.

The target count for the traditional store footprint will be down to 1,200 by the end of 2018. This represents a reduction of over 40% from the peak during the 2013 merger with OfficeMax.

The Depot is accelerating the opening of its "stores of the future," with 120 or so of these 5,000 square-foot, "local neighborhood" style stores planned by the end of 2017.

I find it quite difficult to project what may come next in this sector of the reseller market. We know there will not be a combination of the two big guys from which the most synergies could be extracted, and a more robust enterprise could probably be created. We know both Staples and Depot have positive cash flow and strong balance sheets, while Depot, at least, believes its shares are undervalued. Neither enterprise is distressed nor likely to leave the business, so where may they be going?

Some possibilities:

Amazon acquires either Staples or Office Depot

A Chinese investment group receives either Staples or Office Depot

U.S. Private Equity acquires either Staples or Office Depot

Staples continues to develop the best Tier 1 dealers

Depot continues to wring out synergies from the OfficeMax acquisition

Otherwise, continue as-is

Longer-term, I think both Staples and Depot face significant challenges. Of the potential scenarios listed above, I guess a combination of options four, five, and six is the most likely. Potential acquirers will sit on the sidelines while the market continues to mature.

What about the other two channels?

The Independent Resellers

The outlook here may be more predictable. It's interesting that Office Depot still considers a brick-and-mortar presence essential for local markets, as indicated by their plans for opening 120+ of their new "stores of the future" retail concept. These plans suggest that Office Depot believes there's still a need for a physical presence in local markets. This implies there may also be an opportunity for independent resellers to leverage their regional footprints so long as they develop capabilities to match the service and performance standards of Depot and Staples. However, regardless of whether or not the independent resellers can effectively compete with Staples and Depot in their local markets, I expect a significant thinning of the ranks. The strongest Tier-2s will acquire the best of the Tier-3s and will then be acquired by the strongest Tier-1 players. Many of the weakest Tier-3 will go out of business.

The Internet Resellers

What most people may think of in terms of e-commerce and the future may not be how it plays out, at least not in the short and medium term. As we know, Amazon is the powerhouse of e-commerce, even though Staples and Office Depot also have robust e-commerce portals.

It's clear Amazon wants to break into the B2B office products channel, and we know, from Staple's efforts to convince the FTC to allow their acquisition of Office Depot, that they (Staple's) fear the threat of Amazon in this B2B space. Fortunately, at least in the short term, for Staples and Depot, it appears the Amazon B2C platform is unsuitable to meet the needs of the typical B2B customer they currently serve. However, given Amazon's resources, it may only be a matter of time before they figure out a solution to this problem and start to win a share in this lucrative market segment.

Overall, I believe the scope for new entrants in the Internet Reseller Channel, at least in competing with Amazon, eBay, NewEgg, LD Products, and even Staples and Office Depot, is minimal.

Of course, we could see some consolidation with Staples, Depot, or even NewEgg, perhaps acquiring LD Products. However, I don't see significant changes taking place with the current leaders that make up the Internet Reseller Channel, apart from the relentless advance of Amazon and the possible entry of Alibaba. However, Alibaba is a whole different story, and I'll try and tackle that later.

In the next post in this series, I'lsummarizeng the merger's endgame before moving on to our perspective on the Consumer Adoption Curve and the potential opportunity for aftermarket office supplies in terms of improved market share. When viewed with the mergers and acquisitions and the Chinese money, th becomes much more evident in understanding why there's likely to be a significant shift in market shares.