Most industries experience consolidation - there are few exceptions, and the office products and supplies industry is certainly not one of them. Part I of this series explained my rationale for believing the aftermarket has passed a significant tipping point. Then I hinted toward the foundation established for the aftermarket manufacturers to increase market share at the expense of the OEMs.

The Aftermarket, Office Supplies, and a Major Tipping Point (Part I)

In the second part of the series, I will expand on why I believe the prospect of an upcoming battle for market share is motivating a new consolidation phase as the OEM manufacturer's endgame moves toward its final stages.

| OEM | TTM Sales ($M) | TTM Profit ($M) | Profit % | Comment |

| Hewlett Packard | 48,000 | 3,800 | 8% | Acquiring Samsung Printer Div. |

| Canon | 32,000 | 1,835 | 6% | |

| Sharp | 20,000 | (2,100) | (11%) | Sold to Foxconn |

| Ricoh | 17,000 | 250 | 1% | Nov 2016 - profits down 85% |

| Kyocera Mita | 12,300 | 900 | 7% | |

| Xerox (ex.Conduent) | 11,000 | 275 | 3% | Splitting in two - complete end of 2016 |

| Konica Minolta | 8,500 | 266 | 3% | Nov 2016 - Profits down 30% |

| Seiko Epson | 8,500 | 380 | 4% | |

| Brother | 5,300 | 275 | 5% | |

| Okidata | 4,213 | 100 | 2% | |

| Lexmark | 3,500 | (40) | (1%) | Sold to Apex / Ninestar |

| Samsung (Est.) | 1,300 | 26 | 2% | Selling to Hewlett Packard |

| 171,613 | 5,967 | 3% |

Twelve companies are on this list of OEMs, but a quarter of them (Lexmark, Samsung, and Sharp) are already being merged into other entities.

Hewlett-Packard split into two separate entities at the end of 2015, and Xerox is doing the same in a process expected to be completed by the end of 2016. Both restructurings were designed to separate the mature hardware and supplies business from the (perceived) higher growth potential of the consulting and services businesses. In establishing standalone enterprises focused on printing and supplies, both entities are (or will be) better positioned for the merger endgame!

I believe this group of OEM manufacturers will continue to consolidate and, within a few years, it's possible we could be down to as few as four or five companies. This is typical late-stage industry consolidation behavior.

Sharp

Sharp, with $20 billion in global sales, had been in a steep decline losing over six billion dollars of its net asset value between 2010 and 2016. Foxconn stepped in to rescue an otherwise bankrupt corporation, mainly because they wanted the screen display technology for the Apple iPhone they assemble, and most likely not the relatively small office printing and supplies business. It isn't easy to see Foxconn (a contract manufacturer) committing longer term to the office products business, so either expect to see it closed down or sold to one of the remaining Japanese OEMs.

Lexmark

A $3.6 billion cash offer was too good to ignore. Having exited the ink business in 2012, Lexmark already knew it did not have the scale to compete with the more prominent players and did not have the resources, capital structure, or energy to survive as an independent player in the merger endgame. In selling the business, it appears they acted in the best interest of their shareholders.

Hewlett Packard

Think for a moment about this development.

Perhaps it was motivated by a desire to establish a more substantial presence in the so-called "A3" market, as we've read in the press. We know Managed Print Services, widely adopted in this channel, are a "sticky" sale where the isolated cost of an ink or toner cartridge is obscured under the complexity of a cost-per-page model bundling cartridges with service, repair and (sometimes) even hardware. Long-term contracts are certainly an effective way to protect market share from circling predators!

But also think about the following;

Hewlett-Packard knows (along with all the other OEMs) they have lost the battle to eliminate aftermarket products from the competitive environment and that they need to position themselves to defend against the increasing threat posed by the aftermarket manufacturers and Tier-2 resellers.

Whatever icing is put on the cake to explain the importance of a past and future relationship with Canon, acquiring the Samsung Printer Business is a massive development.

I regularly use my example of a $100 OEM cartridge sale and its associated manufacturing cost of $10. With $90 of gross margin, you'd think the OEMs would be in a solid position to defend their market shares.

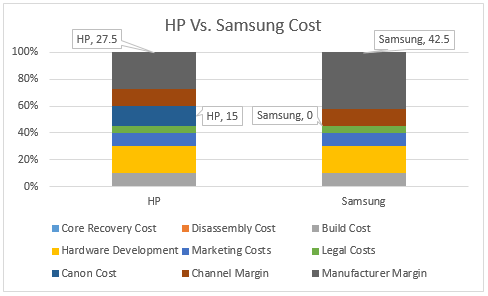

However, look at the chart below - I think it helps demonstrate another compelling reason why the Samsung acquisition is to take place.

We know (give or take a bit) it only costs around $10 to make a new-build cartridge with a retail sell price of $100. However, the fully loaded cartridge cost is estimated at over $70 once hardware subsidies, marketing costs, legal costs, and channel distribution (reseller margins) are all factored in. Look at the call-outs in the above chart. A portion of HP's current cartridge cost (when manufactured by Canon) must be the payment made to Canon. We don't know what that actual number is, but, whatever it is, it's not part of the Samsung cost structure. In our model, HP will improve its margin on cartridges from 27.5% to 42.5% after Samsung is fully incorporated. All the other costs are assumed to be the same, but in the future, HP will not be paying Canon a share of the value chain as the industry moves closer to its endgame.

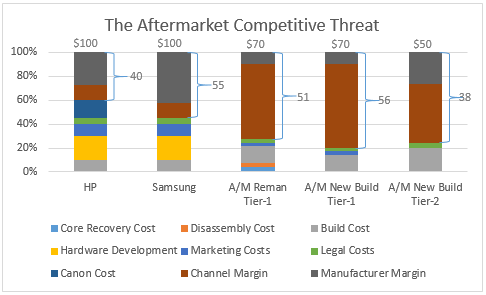

Now let's look at the competitive threat by introducing three aftermarket elements as shown in the chart below.

1. The Tier-1 resellers selling aftermarket remanufactured cartridges generally sell at about a 30% discount to the OEM cartridges; there are a total of $51 margin dollars in the value chain, assuming a $70 sell price.

2. If the Tier-1 resellers elect at some point to sell new-build aftermarket cartridges, then our assumption is they will also capture the incremental margin dollars resulting from the manufacturer's lower cost of goods sold, increasing their share to 88% of the $56 then available. It's not expected there would be a reduction in retail prices.

3. With the Tier-2 resellers represented in the final column of the chart, this is where it starts to get interesting. At an average 50% discount to OEM retail prices and a 30% discount to aftermarket Tier-1 prices, there's still room for $38 margin dollars or 76% of the projected sell price. Furthermore, this channel is where the OEM has less influence to distort normal competitive behavior.

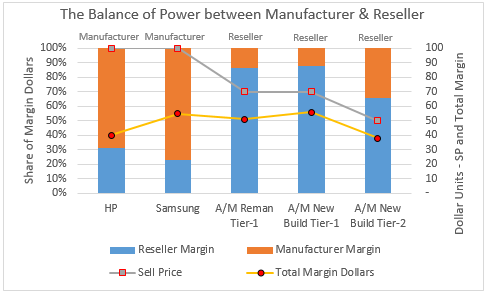

The chart below is a little trickier to understand, but it's essential to do so to understand the OEM thinking and what's driving their endgame.

There are three critical points:

Firstly, the total margin dollars and how they are distributed.

Secondly, who has the balance of power (as labeled above each chart column) in the relationship between manufacturer and reseller as determined by the share of margin dollars? If the reseller margin (blue) is more significant than the manufacturer margin (orange), then the reseller holds the balance of power and vice versa.

Thirdly, the different value propositions - OEM at $100, Tier-1 aftermarket at $75, and Tier-2 aftermarket at $50

1. Let's consider the HP and Samsung examples first

We've already established the Samsung acquisition will reduce HP's costs as Canon is cut out of the picture. However, because HP (along with all the other OEMs) has the balance of power in their relationship with the resellers, none of this increase in their margin will be shared with the reseller, and retail prices will not change.

2. Now let's look at the aftermarket and the existing remanufactured cartridge model through Tier-1 distribution

Over 80% of the margin dollars go to the reseller, so they have the balance of power in their relationship with the aftermarket producer.

At this time, Tier-1 resellers have not adopted new-build compatible cartridges. Perhaps the OEM's dominant power position has been leveraged to exert influence - who knows? However, even if this should change for any reason, any improvement in the total margin dollars will most likely go to the reseller because they have the balance of power and will demand the extra margin dollars while maintaining the ability to keep the selling price unchanged.

The potential adoption of New-Build aftermarket cartridges by the Tier-1 resellers would be unlikely to represent an increased threat to the OEM's and their existing market shares.

3. New-build compatible cartridges through Tier-2 distribution

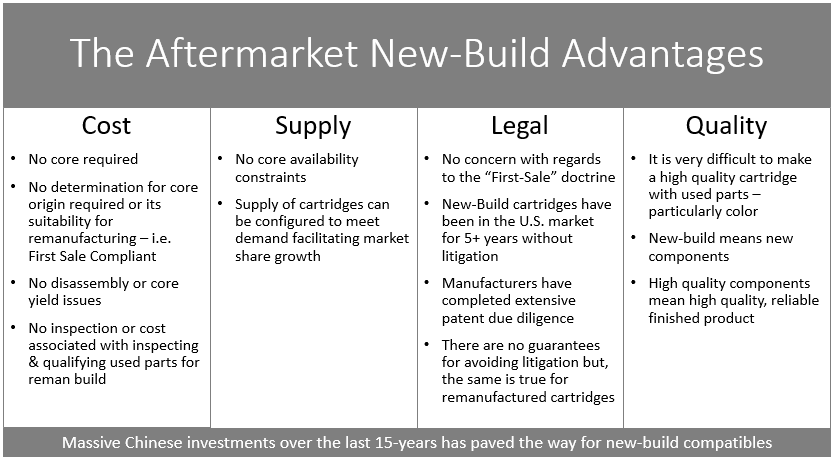

This is the sector of the resale channels from where the potential threat of disruption comes. The OEMs have much less influence over the behavior of this sales channel, and when combined with the value proposition, it has the potential to erode OEM market share. As shown in the graphic below, new-build cartridges have a lower cost, available supply, potentially fewer legal concerns, and higher quality than remanufactured cartridges. Tier-2 resellers leveraging these attributes should establish a clear competitive advantage over the OEMs and the Tier-1 resellers of remanufactured products.

In this series, I'll explore the Tier-2 reseller's opportunities and tactics for developing increased market share in later blogs. Have no illusions - there's no silver bullet or overnight solution to accomplish this! It will be hard work, and anything short of the service and value proposition currently provided by the Tier-1 resellers will be inadequate and fail.

The threat of loss of market share is contributing to the mergers and acquisitions activity now taking place between the OEMs, as the strongest acquire the weakest and attempt to extract as many costs from the business model as possible. The OEMs can't afford to lose market share, and they can't afford to protect it in a protracted price war with the resellers. Given that the Tier-1 resellers will unlikely change the existing pricing model, then the threat can only come from the Tier-2 sales channels.

- 9000Pa SUCTION POWER – Removes stuck debris, dog fur, even wet spills!

- PORTABLE & WIRELESS – 25 mins runtime, charges via USB (compatible with power banks).

- 4 NOZZLES INCLUDED – Clean auto interiors, electronics, upholstery, hard-to-reach spots.

- Glowing Feedback: 4.2? from 650+ buyers – "Outperforms my $60 vacuum!"

?? HIGHLIGHTS:

? PRICE - $7.38

? 4K+ Purchases – Loved by thousands!

? FREE Shipping to the US with tracking.

?? WARNING:

?? LAST 23 IN STOCK – Previous restock sold out in 4 HOURS!

?? Don’t pay $30+ at Walmart – this does MORE!

YES! I WANT MY $7.38 VACUUM ? <a href=https://ify.ac/1gaD>aliexpress.com/vacuum-deal</a>