We're all constantly striving for sales growth, right? After all, if we sell more, we make more, don't we? Sales growth must be based on profitable sales before we make more - but that's another topic.

Here, I will write about real sales growth targets and the importance of customer retention to help achieve those targets. To improve retention, a small reseller business in the office products market must have a compelling value proposition, along with a strong focus on the following:

Leveraging the internet, your website, attracting visitors, and converting customers

Developing local businesses supported by e-commerce capability

Building and leveraging business relationships in local markets

You simply must implement a CRM platform.

Your CRM must become the central database that holds all your customer contact information, activities, tasks, and is actively used for managing your sales pipeline.

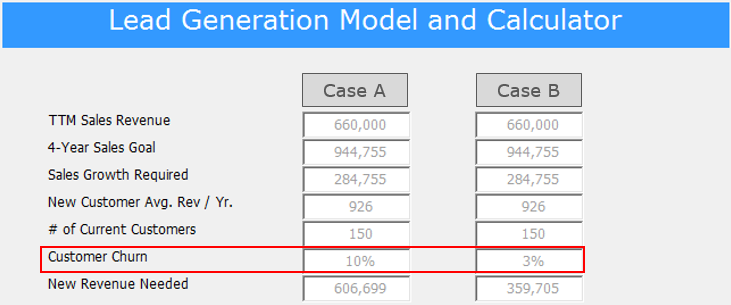

Here are some assumptions for a "Case Study" Office Products Reseller business:

- $660,000 in revenue, 10% churn, and 4% new customer acquisition

- 150 active customers placing an average of 150 orders per month

- Website designed for effective content-driven marketing

- Social media accounts (LinkedIn, Google+, Twitter, and Facebook) are all set up and optimized - a total audience of 1,000

- Clean email contact list of 1,000 opted-in subscribers and poised to achieve a 20% open rate and 10% click rate on a weekly campaign

- Publishing one blog per week with relevant and valuable educational content

- Actively using CRM to manage customer relationships

- A goal to increase sales revenue from $660,000 to $945,000 over four years - a compound annual growth rate of 9%

On the face of it, all this business has to do is;

- Keep its existing book of business ($660,000), and

- Win $285,000 of new business

Aggressive? Maybe, but not hopelessly unrealistic. However, our case study has a fundamental problem that makes this goal much more complicated than it could otherwise be:

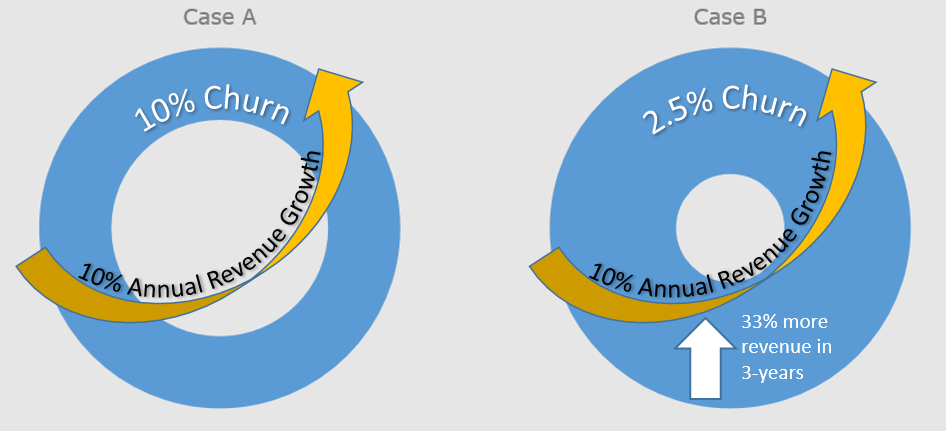

Let's look at the Case A and Case B scenarios below:

The ONLY difference between Case A and B is the different customer churn assumptions - Case A is 10%, and Case B is 2.5%. The impact is dramatic. To achieve the 4-year revenue growth plan of $945,000, Case A needs to generate over $600,000 of new business, and Case B only $360,000! Case A is 2X the sales revenue increase between $660K and $945K, and Case B only 1.25X.

Our recent blog on the "silent killer" also explained the inverse relationship between customer churn rates and acquisition. The higher the churn, the lower the investment. So, to increase revenue at a rate of 10% per year alongside 10% churn, it will be a long uphill battle to generate $600,000 of new income. Effectively a new business equal in size to the existing business has to be developed to achieve 50% growth - one-third of the company you have and one-third of the new business you win will be lost to churn!

If the underlying issues causing 10% churn are not fixed, then the chances are the business development goals will not be achieved.

Successfully improving churn to 2.5% reduces the new revenue needed to achieve the plan goal from $600,000 to $360,000 - a 125% multiple on the $285,000 growth goal instead of 200%!

Improving the value proposition using market intelligence and digital technology will reduce churn and increase customer acquisition rates. So, before you can think about increasing your revenue to 10% per year, you need to have your churn in the region of 2 - 3%. This means your customers must be satisfied with your value proposition's components.

Our next blog in this series will focus on the sales funnel underneath the revenue target, along with explanations of lead generation and conversion. Using a simple set of assumptions, I will explain the math to demonstrate the relationship between website visitors, lead transformation, and new customer acquisition.