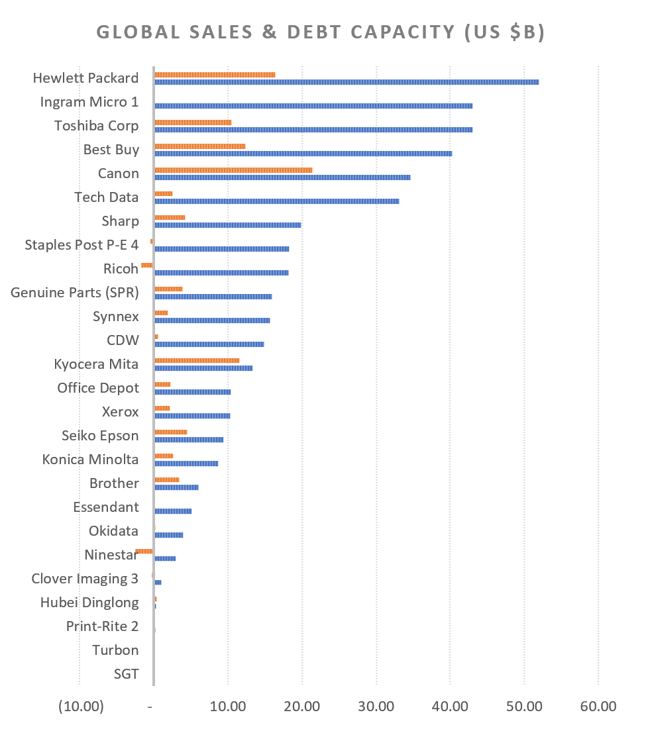

We're tracking the financial performance of 26 of the major players in the imaging supplies and business equipment industry. Between them, they have global sales of $420 Billion, $30 billion of EBITDA, and $100 billion of debt capacity. Of course, these numbers are heavily weighted as the top five accounts for nearly 60% of the total EBITDA and 75% of the debt capacity.

The following table can be sorted according to each of the columns. Click on the down arrow in the column header to re-sort.

The analysis uses a multiple of 4X EBITDA as the threshold for exceeding conservative debt leverage.

Channel Key:

- O = OEM

- R = Retailer

- W = Wholesaler

- A/M = Aftermarket Manufacturer

Footnotes:

- Ingram Micro - sold to China HNA Group - Private Company - no data available. Last known sales number was $43B before closing the HNA deal in December 2016.

- Print-Rite - Private Company - no data available. Sales estimated.

- Clover Group - Private Company. Limited data is available. Estimates from Moody's Rating Report October 2017.

- Staples, Privatized in $6.9B Sycamore Partners Deal completed in June 2017. Sales estimate from pre-privatization and balance sheet debt estimate assumes $6B of the privatization funding now on the balance sheet.

It's usually the case that the largest enterprises with the biggest EBITDA numbers have access to the most debt capacity and, when using a combination of profits, debt, and even equity where necessary, have the most flexibility to deal with the ongoing challenges of operating a business, particularly one that's part of a mature, consolidating industry.

Enterprises with access to funds have the most options available regarding the potential for merger and acquisition strategies, diversification into emerging new product categories, channel diversification, etc. Just cast your eye to Hewlett Packard and;

- Their acquisition of the Samsung Printer Business

- Their development into industrial-scale 3D printing technologies

- Their announced target is to leverage the Samsung A3 capabilities to develop their market share in the $50B+ A3 (Copier) channel.

Without a strong balance sheet and a profitable business, these strategic initiatives would not be options for them to pursue.

What we're highlighting in the following table is the most significant movers from the 52-week high and low share prices.

Thirteen of sixteen share prices have moved up more than 25% from their 52-week lows, and only six have moved down more than 25% from their 52-week highs. In other words, more of the share prices are closer to their 52-week highs than they are to their 52-week lows.

These are challenging times for most businesses in the office products and business equipment industry. Seismic changes are occurring within the industry and, perhaps more importantly, with how business is conducted. Rapid developments in software, the internet (connectivity and the internet of things), and consumer buying habits (e-Commerce) all combine to mean inefficiencies are being stripped out of the business process.

The collection of data is increasing at exponential rates but, for those leveraging this into actionable business intelligence, opportunities exist to develop competitive advantages that can be leveraged to increase market share.

These factors all combine to change how we operate in an office environment, what we print, how much we print, where we actually work from, and what devices are used to print. The paperless office has been talked about for decades. While we may never experience a 100% paperless environment, there's now much greater clarity about the expectation for significantly reduced print volumes and lower consumption of other related office supplies.

These trends have profound implications for the transactional business environment. Total pricing transparency has emerged due to Amazon's disruptive presence in many industries, including office products. Revenues for many resellers of office-related products are decreasing faster than the overall market shrink, so it's logical to conclude a transfer of business is taking place.

The changing market conditions are not reversible so, it's also logical to conclude that those who don't change the way they do business will lose revenues in the future even quicker than they have been in the recent past. Eventually, resellers that fail to adapt will go out of business.

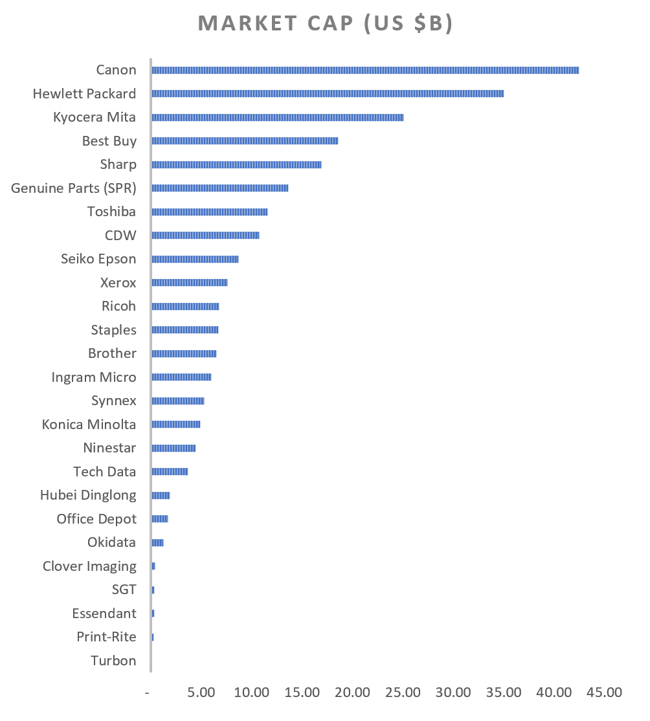

Among the group of 26 companies, we've included a cross-section of original equipment manufacturers, aftermarket manufacturers, office products retailers, electronics retailers, and a diversified industrial conglomerate. We believe this gives us a good perspective of how effectively companies like Best Buy, Office Depot, and Staples compete with Amazon. It provides us with a view of how the reduced demand for office products affects companies like Essendant, SP Richards, Clover, Office Depot, and Staples. It shows us how the most powerful companies, like Hewlett-Packard, Canon, and Kyocera, are positioned to take advantage of the current business environment.

It also gives us a view of which companies face the biggest challenges regarding their access to financial resources that may be required to adapt their businesses to the new environment. The default sort order for the first table in this article is debt capacity. The higher the placement on this list, the greater the financial resources to deal with change, and the lower on the list, the fewer resources available to do the same.

Office Depot's recent acquisition of CompuCom is not reflected in the debt number, adding approximately $700 million to its balance sheet. This represents about one-third of their previously available debt capacity (as measured by a multiple of 4X EBITDA), resulting in post-acquisition debt coverage of 1.5X EBITDA and still conservative based on their short-term financial outlook.

However, this debt leverage could change quite quickly should (for example) a 10% reduction in their pre-Compucom top line ($1B) and a 60% contraction of EBITDA ($375M) take place. This scenario would place the combined Office Depot CompuCom business at a debt-to-EBITDA ratio close to 4X, and approaching debt levels, investors will exhibit high levels of anxiety over. This acquisition, and how vital it is for them to transform their business away from transactional to services-generated revenue, will define their future. It works; they survive, it fails, and they're more likely to fail.

Conclusions:

It doesn't matter if a business has $40 billion in revenues, $40 million, or even $4 million; the same basic business conditions affect them all. A reseller operating in the office products and equipment vertical with $40 million in annual revenues faces the same structural shifts in market conditions as an OEM with $40 billion in annual revenues. However, what does differ is the scale at which larger enterprises have to act to move the needle.

As we've seen, Office Depot has staked its future on a $1B deal to move into the services-oriented sector, and HP has paid $1 billion to acquire the Samsung printer business that it hopes will enable it to make a more serious play in the $50 billion A3 copier channel market. Depot's deal can be bench-marked at around 10% of its annual revenue versus HP's at 2%, and each deal's risks could be considered in the same context. The point is that the bigger the enterprise, the bigger the deals and the bigger the associated risks. Smaller businesses, with far less in terms of financial resources but facing the same structural issues as the biggest enterprises, have far fewer options to consider when contemplating how to deal with these issues.