We have built a case that there is little opportunity for independent resellers to grow in a shrinking market without improving their value proposition. However, growing in a shrinking market means increasing market share. This objective is difficult without a compelling value proposition that successfully differentiates a business from its competitors.

We have explained the importance of closing the technology gap between large and small enterprises, with our usual emphasis on independent resellers in the office products, supplies, and business equipment verticals.

We have introduced the concept of alternative aftermarket replacement cartridges as a viable value proposition while recognizing these alternatives will not always be suitable for everyone.

Now, we will examine the barriers that have historically prevented aftermarket alternatives from gaining a stronger foothold in the marketplace and the role technology must play to start removing these barriers.

Most businesses have a few straightforward high-level objectives.

1. Maximize sales revenue

2. Maximize profitability

3. Exceed customer expectations

Sales Revenue:

Within this framework of objectives, the concept of offering aftermarket replacement cartridges introduces some complications because it compromises the natural tendency of a business owner to focus on sales revenue. Selling aftermarket alternatives means generating less income because they always sell for less per unit than the higher-priced OEM brand cartridges.

Profits:

However, mitigating the reduced sales revenue are the (much) higher margins that can be generated by selling aftermarket alternatives compared to original OEM brand cartridges. Bottom line, most business owners who can overcome their tendency to focus on the top bar can prioritize maximizing profits over sales revenue. If this can be accomplished, the first hurdle to accepting the role of aftermarket alternatives in the overall value proposition has been overcome.

Customer Expectations:

Next is the requirement for exceeding customer expectations. Failing in this objective introduces a myriad of issues centering around customer retention. In our digital environment of unlimited alternatives and instant feedback, fulfilling customer expectations cannot be compromised. Historically, the reliability and performance of aftermarket alternatives have been patchy, and OEM marketing campaigns amplify the risks of off-brand, cheaper options and make consumers wary. Resellers must be confident about the consistency and quality of aftermarket alternatives before introducing them to their value proposition.

Reducing Customer Spend:

On the flip side of the quality risk, there's the upside of saving customers' money. There's no doubt this aspect of a customer relationship is a significant contributor to overall supplier satisfaction. However, it should not be expected that a customer must be willing to compromise on quality to get a lower price.

OEM Power:

We cannot ignore the power of the OEM relationships as a significant component of the barrier preventing greater market penetration of aftermarket alternatives. Many resellers have OEM authorizations that come with certain obligations and restrictions. We must remember an OEM resale authorization has value for a reseller, and the reseller's decision to seek and maintain a charge is its choice, not the OEMs. It's not unreasonable that the approval comes with some obligations, such as quarterly and annual sales targets. Agreeing to sales targets with OEMs that result in charges to resell their products and then aggressively pursuing a conversion strategy to sell aftermarket alternatives carries the risk of compromising those sales targets. Ultimately, missing sales targets may compromise the status of an authorization which may, in turn, have more significant implications for a reseller.

Logistics:

Another formidable barrier confronting the more widespread introduction of aftermarket alternatives is logistics. We cannot ignore the difficulties a typical reseller faces when managing its product offering, pricing, and daily purchasing optimization decisions.

Pricing Logistics:

The complexity of the pricing logistics cannot be overlooked as a barrier to distribution. A typical office products reseller may have 60,000 or more products in its catalog. Many of these will be items provided by the two national wholesalers, Essendant and SP Richards, who independently offer pricing tools to their individual product catalogs.

Consider the complexity of bringing in products outside the two wholesaler catalogs, or for that matter, even just choosing between the two catalogs. We will now explain these problems in the context of a "simple" model.

A Simple Model:

[DISCLAIMER: THE COMPANY NAMES AND COST EXAMPLES USED IN THIS EXAMPLE ARE FOR ILLUSTRATIVE PURPOSES ONLY AND ARE NOT REPRESENTATIVE OF A SPECIFIC CARTRIDGE OR SPECIFIC COSTS FROM ANY OF THESE PROVIDERS.]

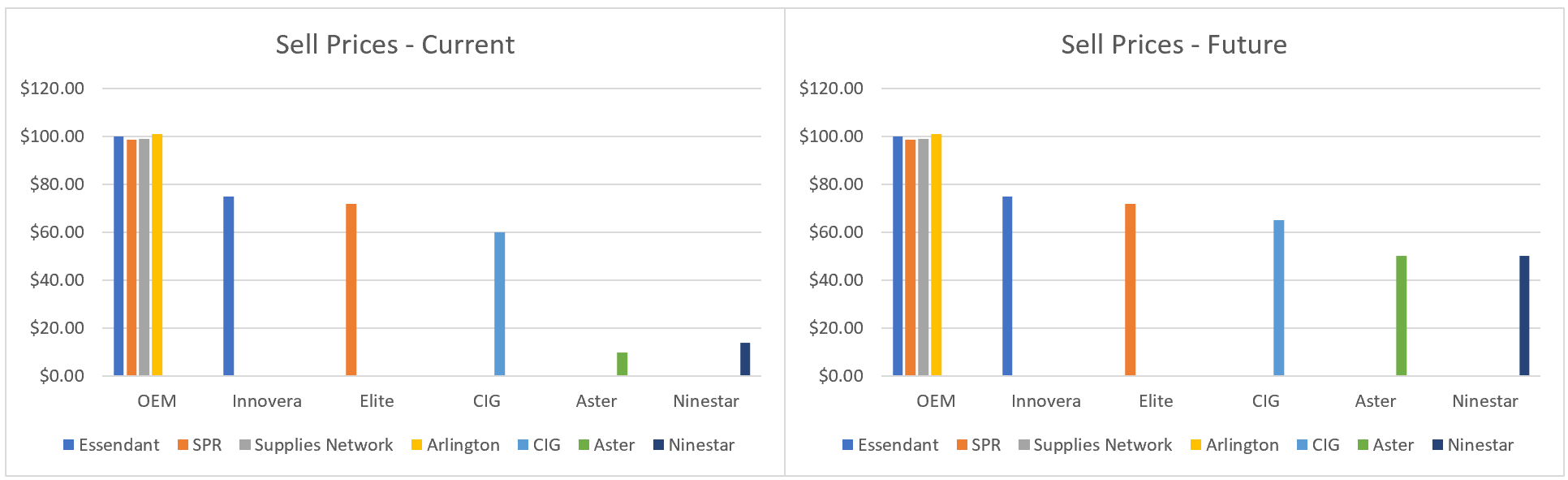

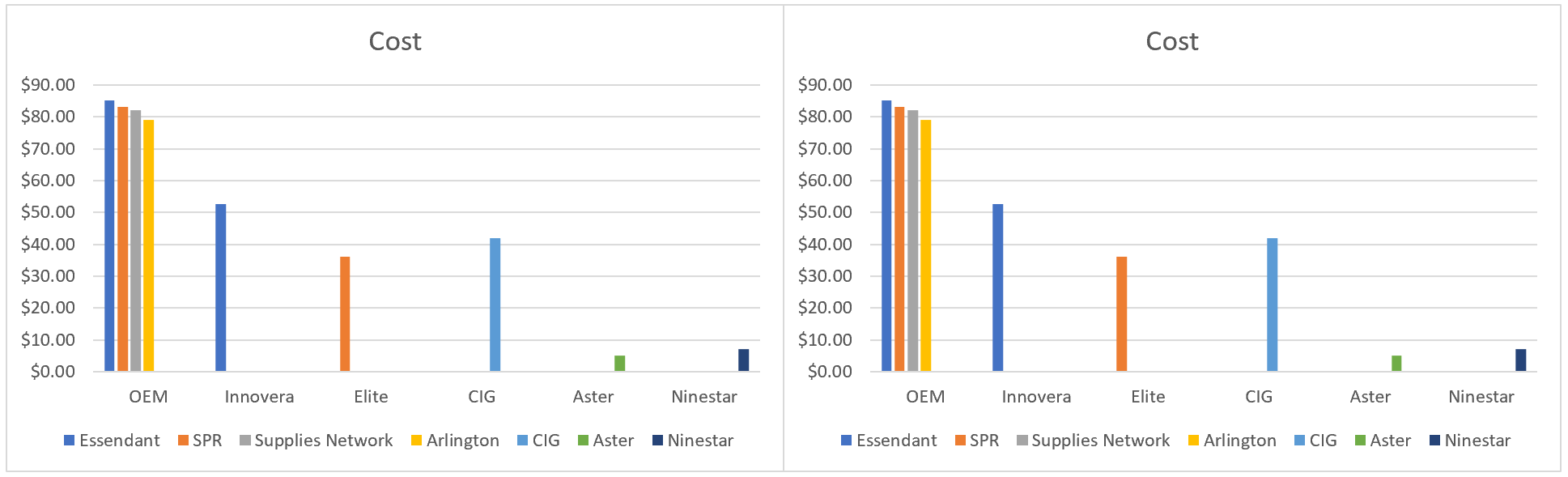

To illustrate our point, we have selected a fictitious OEM cartridge model that's available from multiple sources such as Essendant, SPR, Arlington, and Supplies Network, and has various aftermarket alternatives available, including Innovera (Essendant) and Elite (SPR), plus other options direct from Clover Imaging Group, Ninestar, and Aster Graphics.

Essendant's pricing model will price the Essendant products, including the OEM and Innovera brands. SPR's pricing model will price the SPR products, including the OEM and the Elite brands. Neither of their pricing platforms will price products sourced directly from alternative suppliers. This leaves the reseller to figure out their pricing on these products, which, because of the number of products involved, usually means resorting to cost-plus, as illustrated in the charts labeled "current" (left-hand side) below.

What we see here, in the selling price model, is a cluster of similar prices for the OEM products and rational market-driven pricing for the Innovera and Elite wholesaler "house-brand" alternatives. The problem develops when adding CIG, Ninestar, and Aster alternatives. The calculated selling price is too low in a cost-plus pricing scenario, even with 50 margin points on the Ninestar and Aster products. Equally, for the CIG product, there's no knowing where overall pricing will end up when using a cost-plus approach on a wide range of products. It may work okay (by accident) on some products but will be high on some and low on others.

What we see here, in the selling price model, is a cluster of similar prices for the OEM products and rational market-driven pricing for the Innovera and Elite wholesaler "house-brand" alternatives. The problem develops when adding CIG, Ninestar, and Aster alternatives. The calculated selling price is too low in a cost-plus pricing scenario, even with 50 margin points on the Ninestar and Aster products. Equally, for the CIG product, there's no knowing where overall pricing will end up when using a cost-plus approach on a wide range of products. It may work okay (by accident) on some products but will be high on some and low on others.

Researching buyer's are filtering their options towards experts in the field. However, it's difficult to earn the position of an expert if you can't even demonstrate the ability to price your products to market.

In our model, a 30-point gross margin calculates the price for the CIG alternative at $60. Perhaps this is under-priced, and the dealer would prefer it to be closer to the cost of the Innovera or Elite brands. Unfortunately, this outcome is not practical for a reseller to achieve because it requires a time-consuming and error-prone manual process.

In the cost model above, we can see slight variations in the cost for the OEM branded product from each of the four suppliers, thereby introducing the problem of deciding which is the optimum supplier to buy the equivalent effect. We also see the costs for the Innovera and Elite aftermarket brands and the costs for direct purchases from CIG, Ninestar, and Aster.

In the cost model above, we can see slight variations in the cost for the OEM branded product from each of the four suppliers, thereby introducing the problem of deciding which is the optimum supplier to buy the equivalent effect. We also see the costs for the Innovera and Elite aftermarket brands and the costs for direct purchases from CIG, Ninestar, and Aster.

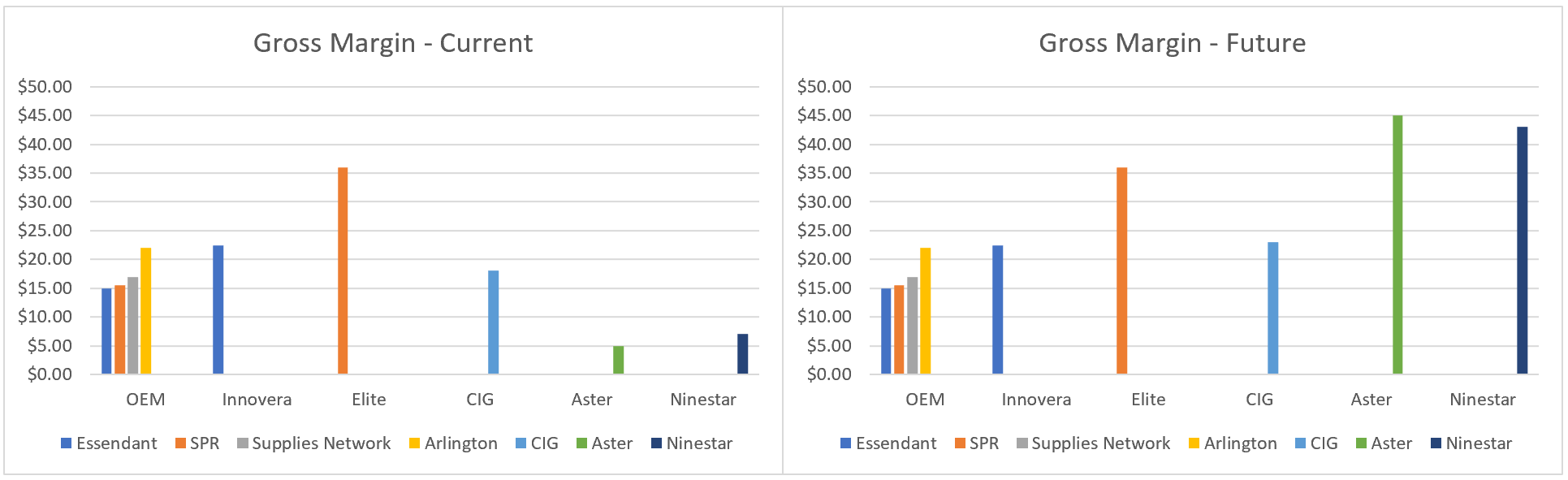

Finally, we look at the gross margin model and introduce the "future" charts shown on the right-hand side of the two side-by-side charts. What we've done here is to present market pricing for each of the alternatives, a strategy designed to eliminate the cost-plus pricing issues that otherwise occur. You now see the CIG alternative priced at $65 and the Ninestar and Aster products priced at $50.

Finally, we look at the gross margin model and introduce the "future" charts shown on the right-hand side of the two side-by-side charts. What we've done here is to present market pricing for each of the alternatives, a strategy designed to eliminate the cost-plus pricing issues that otherwise occur. You now see the CIG alternative priced at $65 and the Ninestar and Aster products priced at $50.

The outcome of all this is that the highest gross margin on the OEM cartridge is earned from the Arlington-supplied cartridge at $22, and the highest gross margin on an aftermarket alternative (when it's priced to the market at $50) is earned on the Aster cartridge at $45.

The overwhelming complexity of the problem should be apparent. Without technology analyzing these different options and using algorithms to calculate optimal outcomes, it is almost impossible for a reseller to offer an alternative value proposition to its customers.

Purchasing Logistics:

The introduction of aftermarket alternatives should not involve any blind product substitution on customer orders. To comply with the customer satisfaction requirement, the reseller must deliver what the customer orders. To contextualize the complexity of this, think about the following logistics considerations for a non-stocking reseller:

1. Customer orders 10-line items totaling $1,000

2. Nine line items come from a wholesaler's catalog and will be delivered to the reseller the next day.

3. Reseller will then deliver the order directly to its customer.

4. The remaining line item ($100 of the $1,000 order) is a third-party cartridge from a different supplier.

5. The lead time is two days, not the next day. This means holding back 90% of the order to deliver 100% complete or making two deliveries. Both the customer and reseller incur actual costs with either option.

6. The saving to the customer in selecting the aftermarket alternative was $50, and the increased profit to the reseller was $75. However, the single order from the third-party supplier carried a $15 freight charge, reducing the margin improvement to $60.

7. It also reduced purchases from the wholesaler that must be accounted for in their growth rebate program and the OEMs.

Consider these purchasing complexities in the context of a $5M "non-stocking" office products reseller who may be placing 100 or more orders per day, each of which may contain an average of five or more line items. Reviewing these orders in the context of the complexity outlined above cannot be accomplished manually, so the reseller quickly concludes it's more trouble than it's worth. It is forced to pass on presenting the alternative value proposition to its customers.

It should be clear there are real and significant barriers that combine to prevent aftermarket alternatives from achieving more outstanding market share. This is despite the fact they can save the reseller's customers' money and earn the reseller themselves higher margins. However, because sales and profits are the most critical business requirements (especially in a mature, declining market), there should be ample motivation to implement a solution that overcomes these barriers.

Those that utilize technology to help overcome these barriers will stand a better chance of growing their business profitably despite the declining market.

At this stage, we believe we have laid enough groundwork to have illustrated the concept of deploying technology to create a differentiating capability and that adding aftermarket cartridge alternatives to the value proposition can help the reseller increase market share and improve its profitability.

What next?

We haven't yet illustrated the scope and capabilities of a technology solution necessary for removing the barriers and permitting the resellers to offer a broader range of items, including those outside the national wholesaler's product catalogs. Products that can be seamlessly incorporated into their value proposition while optimizing the entire record to maximize sales and profits.

However, before we conclude this series with an explanation of the necessary scope and capabilities of a technology solution, the following (upcoming) post will outline the online strategy and explain the obstacles currently associated with the reseller's website and social media presence. These online components must play together to help communicate the value proposition, build awareness, and satisfy researching buyers (at various stages of their individual buying journeys) for the ultimate technology solution to fulfill its potential.